Science-Based Targets for Private Equity Real Estate Investments

18th Aug 2022

Howard Shih (Research Associate) from the Science Based Targets initiative (SBTi) and Myles Tatlock (Principal Consultant) and David Koram (Senior Consultant) from Anthesis* explain how real estate private equity investments can set and achieve science-based targets.

*The SBTi does not endorse, recommend or support any particular consultancies.

Buildings account for ~37% of global carbon dioxide emissions and are an essential part of the transformation to a net-zero economy. As investors in real estate, private equity (PE) firms have a key role and unique responsibility in helping to decarbonize the built environment.

This blog outlines how to set and start achieving science-based targets for real estate PE investments in line with the SBTi Private Equity Sector Science-Based Target Guidance (PE Guidance) and more general real estate guidance in the Financial Sector Science-Based Targets Guidance (FI Guidance). Additional work is planned under the SBTi’s Buildings Project, which is detailed further in a previous blog, to develop new methodologies, tools and target-setting guidance for both corporates and financial institutions to set a global pathway for all buildings’ emissions to align with 1.5°C.

“Eurazeo looked to science-based targets for real estate activity as an opportunity. Improved efficiency means not only less GHG emissions, but also lowering operational costs, reducing climate-related risk, enhancing quality of life and improving living standards. “Setting up a decarbonization target and actively working on emission reduction makes the future of the business sounder and safer.” Sophie Flak, Managing Partner - CSR and Digital Director at Eurazeo |

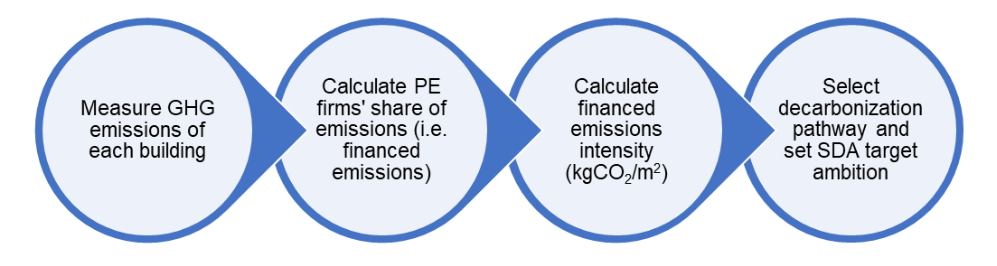

Since real estate PE investments are primarily direct asset-level purchases, the Sectoral Decarbonization Approach (SDA) must be used to set science-based targets on real estate PE investment portfolios, with a minimum target coverage requirement of 67%. The graphic below illustrates the four steps involved.

First, the greenhouse gas (GHG) inventory must be compiled. However, a common challenge for PE firms is accessing high quality granular data such as actual tenant energy use (e.g. due to privacy concerns). Generally, data points should include:

- Buildings’ direct energy-related emissions.

- Buildings’ indirect energy-related emissions, including the energy consumption of the tenants.

- Building type (i.e. residential or service).

- Floor area in square meters (m2) of properties.

- Portfolio growth rate in target year (optional)

The collection of a building’s actual energy-related emissions is preferred. However, in the absence of metered data, they can be estimated based on asset-level data and emission factors (conversion of energy use into emissions). PE firms should then develop a strategy to improve data quality. For example, the energy consumption of buildings can be collected from energy bills or, alternatively, estimated based on building characteristics, such as energy label / index, type of property, floor area and climate classifications (i.e. tropical, dry, mild, continental or polar). There are also some databases available that can provide proxy data to fill in remaining data gaps, such as the:

- Global Services Real Estate Sustainability Benchmark.

- EU Buildings Database.

- PCAF European building emission factor database.

- CRREM Risk Assessment Tool.

- EIA Residential Energy Consumption Survey.

- EIA Commercial Buildings Energy Consumption Survey.

Second, the GHG inventory is attributed to the PE firm (i.e. financed emissions) using an attribution factor equal to the ratio between the outstanding investment amount and the property value at the time of investment.

Attribution factor = Outstanding amount / Property value at origination

The emissions of each invested property are multiplied by the attribution factor of each property, and then summed up.

Financed emissions = Σ Attribution factor x Building emissions

Third, this sum is divided by the total gross floor area at the portfolio level (i.e. the gross floor area of each invested property multiplied by the above attribution factor, and then summed up) in order to derive the financed emissions intensity of the real estate portfolio.

Financed emissions intensity = Financed emissions / (Σ Attribution factor x Gross floor area)

The Global GHG Accounting and Reporting Standard for the Financial Industry, developed by the Partnership for Carbon Accounting Financials (PCAF), provides further details on GHG accounting methodologies for various asset classes, including real estate.

The De Volksbank case study in the FI Guidance (pages 64-67) provides an example of how data points can be derived to calculate the financed emissions intensity of a real estate portfolio: Floor area: The surface area data from the housing units financed by the bank were retrieved from the Dutch Cadastre, which collects and registers administrative and spatial data on all Dutch properties. Absolute financed emissions: This includes total scope 1 and 2 emissions for each housing unit in De Volksbank’s portfolio. De Volksbank derived these emissions by converting the average electricity and gas consumption per energy label to CO2 emissions, using national average emission factors. |

Fourth, SDA targets will need to be set using the global decarbonization pathway for residential and/or service buildings in line with keeping global warming well-below 2°C (i.e. the global floor area projections and emissions intensities pathways defined in the IEA ETP 2017 Beyond 2°C Scenario). The SBTi is also developing 1.5°C-aligned resources for the Buildings sector, including 1.5°C in-use emissions pathways jointly with Carbon Risk Real Estate Monitor (CRREM) to be released in the coming months, as well as embodied emissions pathways and more detailed target-setting guidance expected to launch in 2023.

SDA targets are defined as a reduction in emissions per m2 floor area at the real estate portfolio level. For example, a target could be: “[PE firm] commits to reduce GHG emissions from its real estate portfolio __% per square meter by [target year] from a [20xx] base year.” PE firms can also decide to translate this into an absolute target by factoring in the growth projection (in m2 floor area) of their real estate portfolio toward the target year. A calculation sheet is available for modeling SDA real estate targets.

Upon setting science-based targets for real estate PE investment portfolios, PE firms will need to drive energy efficiency improvements and/or invest in lower-emitting assets in the sector.

The Bank J. Safra Sarasin, Ltd. case study in the FI Guidance (pages 68-70) provides some examples of measures to take at an asset level: A necessary measure will include abandoning fossil fuels, for example, switching to biogas at properties with gas heating and eventually to entirely renewable heating systems. Renewable electricity purchasing needs to be extended to all properties, and, where applicable, on-site PV systems need to be installed…Regarding energy efficiency, the real estate portfolio benefited from a strategy of using building certifications where possible for new construction projects. To further decrease and optimize energy consumption, further efficiency measures such as energy retrofits will be necessary. |

There are, however, open questions still to be addressed such as: the implications of real estate portfolios with high turnover, methods to incorporate embodied emissions, direct vs. indirect investments and target boundaries. In addition to assessing real estate targets, the SBTi is developing new resources to support building data standardization and target-setting including integration with CRREM.

PCAF is also developing additional specifications on a range of technical, data and standards issues relating to GHG from real estate, and recently released the technical guidance document Accounting and reporting of financed GHG emissions from real estate operations for public consultation. In the meantime, further information on using the SDA method for real estate can be found in the FI Guidance (section 5.4.1 (pages 59-73) and appendices (pages 115-135).

How VP Capital is approaching targets for its real estate investments “Of the different targets we have set, we consider the target for our real estate investments the hardest to realize, because the reduction needed (SDA for real estate) is steep and because of the necessary engagement with fund management and tenants. However, we also feel that much progress can and must be made in real estate. “Our approach: 1. Direct investments: for each asset we conduct an energy scan to identify possible reduction measures; 2. Tenants: contract with ‘green lease’ article and incentives to switch to renewable energy; 3. REITs: active dialogue and support to persuade them to do the same for the assets in their control and 4. New investments: (potential) net-zero buildings only.”

|

The SBTi calls on all PE firms to urgently commit to setting a science-based target. Using the PE Guidance, this blog and the below resources, PE firms can set and start achieving climate mitigation targets in line with science.

Introduction to Setting Science-Based Targets for the Private Equity Sector blog part 1 and part 2.

Private Equity Science-Based Target Guidance Walk-Through webinar recording and slides.

Panel Discussion on Meeting Private Equity Sector Science-Based Targets webinar recording and slides.

This blog was updated on August 19th to provide more information about SBTi's Buildings Project.

Latest News

View News