Introduction to Setting Science-Based Targets for the Private Equity Sector (Part 2)

May 24th 2022

The second of two blogs by Howard Shih (Research Associate) from the Science Based Targets initiative and Myles Tatlock (Principal Consultant) and Hanna Westling (Consultant) from Anthesis,* aiming to provide an outline of what is involved in setting a science-based target for Private Equity firms.

*The SBTi does not endorse, recommend or support any particular consultancies.

The Science Based Targets initiative (SBTi) launched the Private Equity Sector Science-Based Target Guidance (PE Guidance) in November 2021 to enable PE firms to set targets for operations and investment portfolios aligned with the emission reductions needed to stay in line with 1.5°C climate scenarios.

Now, the SBTi is launching a PE Guidance blog series and webinar to help PE investors better understand the relevance of setting science-based targets, the key criteria to doing so, available resources for target development and how to prepare target submissions.

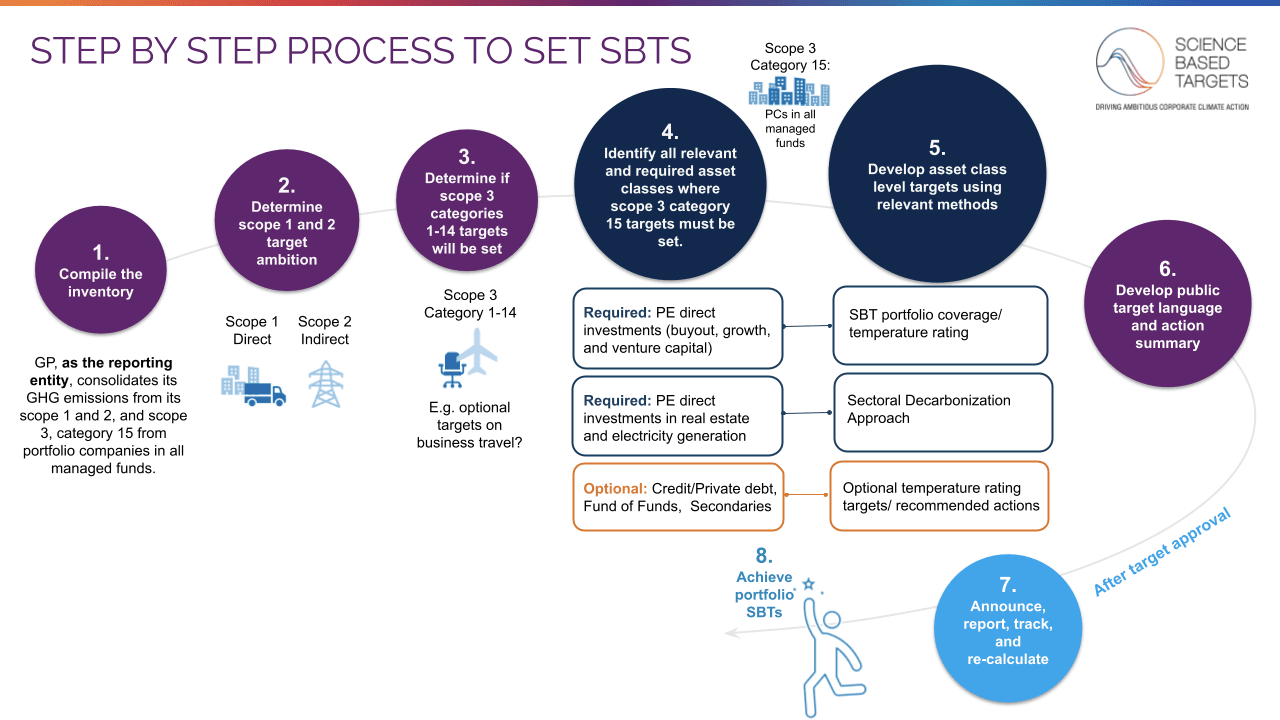

This blog is the second of two that serve as a prelude to the PE Guidance Walk-Through Webinar and aim to provide an outline of what is involved in setting a science-based target and the key practical steps to do so. The first blog provides steps 1-4 for PE firms to set a science based target; this blog details three further steps.

The webinar was held across two time zones on 31 May and 1 June - view the recording here.

Step 5: Develop asset class level targets using applicable method

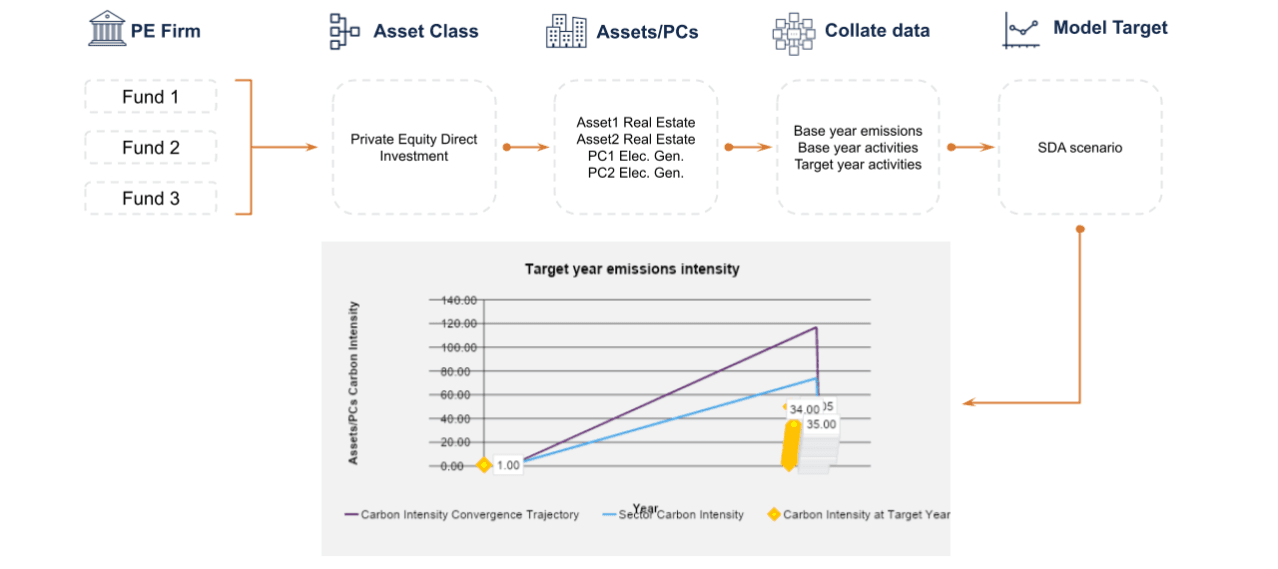

The Sectoral Decarbonization Approach (SDA) is a method for setting physical intensity targets, which is defined by a reduction in emissions relative to a specific business metric (e.g. metric tonne CO2e per tonne of product). PE firms will need to set SDA targets to converge the physical emissions intensity of their direct investments in electricity generation and real estate to a global sectoral level by 2050 in line with a 1.5°C pathway. For additional information on the SDA method, please see section 6.2 of the PE Guidance.

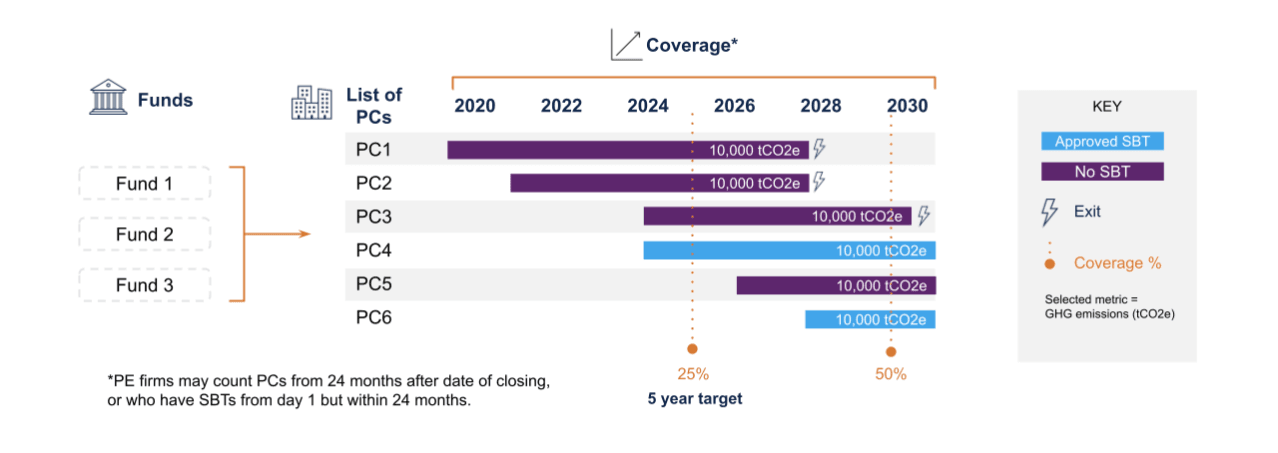

The Portfolio Coverage method is an engagement-based approach that can be best described as a ‘target of targets’. Under this method, a PE firm is required to set a target of up to five years, using a selected metric (GHG emissions preferably, or financial), to have a portion of its portfolio companies set their own science-based targets. The target must, at a minimum, be on a linear path to 100% of portfolio companies having validated science-based targets by 2040. For purposes of target setting, tracking, and reporting, the PE firm may choose to exclude portfolio companies acquired 24 months or less and without validated science-based targets, though it is recommended that this period does not exceed 12 months.

Why have you aligned with 100% portfolio coverage by 2030 (i.e. earlier than 2040)? "We believe every business has a role to play in the transition to a zero-carbon economy, and that if we want to achieve meaningful emissions reductions, we need to take action now. That’s why we are working closely with our portfolio companies to ensure that by 2030 100% of Montagu’s eligible private equity investments have set SBTi validated targets, with the ambition to set science-based targets for all new investments within 24 months of acquisition."

|

An advantage of the Portfolio Coverage method is the progressive ramp up from now until 2040. This provides an opportunity for PE firms to focus their engagement efforts before increasingly influencing additional portfolio companies over time to set science-based targets and reduce real economy GHG emissions. For additional information on the Portfolio Coverage method, please see section 6.3 of the PE Guidance.

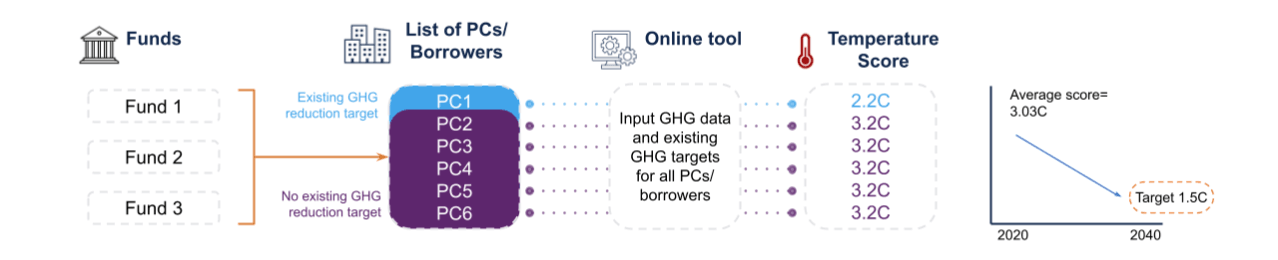

The Temperature Rating method is an extension of the Portfolio Coverage approach that enables PE firms to assess their portfolio temperature rating based on public GHG emissions reduction targets of their portfolio companies. GHG emissions data is required from each portfolio company and where this is not available, proxy data can be procured from a third party such as CDP. In the absence of an existing valid GHG emissions reduction target, a portfolio company is given a default score of 3.2°C, which represents an expected business as usual trajectory for the company, rather than being excluded from the analysis. PE firms must then set a target of up to five years to reduce their portfolio temperature scores (aggregated from their portfolio companies’ scores). The target must, at a minimum, be on a linear path to aligning:

Portfolio scope 1 + 2 temperature score with a well-below 2°C scenario by 2040, and

Portfolio scope 1 + 2 + 3 temperature score with a 2°C scenario by 2040.

The Temperature Rating method allows for a broader engagement approach since the existing or new GHG emissions reduction targets for each portfolio company do not need to be validated by the SBTi. The method is supported by additional resources, including a methodology document, tool user guide and recorded webinars.

Step 6: Develop public target language and action summary

When it comes to reducing PE firms’ GHG emissions, transparency is important to stakeholders – which is why the SBTi provides specific guidance on how PE firms should communicate their science-based targets and the strategies to achieve them. The detailed target language template is provided in table 7.1 of the PE Guidance and additional guidance on formulating target language is included in the FI near-term target submission form. Example target language can also be found in the SBTi Companies Taking Action dashboard page, using the drop down filter for ‘financial institution’ as the organization type.

The SBTi strives to increasingly standardize the language used across different financial institutions so that they are consistent and comparable for external stakeholders.

Submit Targets for SBTi Validation Upon completing steps 1 to 6, PE firms will need to populate the FI near-term target submission form. PE firms may then reserve a date in the SBTi booking system for when their SBTi target validation service will begin. A completed submission form and supporting documentation must be uploaded in order to book a slot. |

Step 7: Announce targets once validated

Upon receiving an official SBTi target approval, PE firms simply need to publish their target language on their own websites.

For information on tracking and reporting target progress, please see section 8 of the PE Guidance.

What was JAB’s experience using the SBTi Financial Institutions framework and Private Equity sector guidance to set its target? “Our experience was very positive. The way the guidance is set up clearly shows that it has been developed with investors in mind. One example is the portfolio coverage approach as a target setting method for emissions from investments (scope 3, category 15). This allowed us to set a target on the share of portfolio investments that have adopted their own science-based targets, which was a logical approach for us because as an investment firm more than 99% of our carbon footprint is linked to our investment portfolio. Furthermore, we appreciated the option to use a financial metric as a proxy for GHG emissions to set our target coverage on scope 3. This allowed us to make progress on setting our target and move quickly towards execution.”

|

After completing these seven steps, a PE firm’s journey to achieving its science-based target begins. A second blog and webinar series focusing more on the implementation stage (i.e. post target validation) is planned to be released in the coming months. In addition, an FAQ document will be developed to answer common questions raised by PE firms. In the meantime, the SBTi community forum for financial institutions provides the primary channel for questions and discussions on the PE Guidance and the wider sector framework.

Latest News

View News