Introduction to Setting Science-Based Targets for the Private Equity Sector (Part 1)

May 17th 2022

The first of two blogs by Howard Shih (Research Associate) from the Science Based Targets initiative and Myles Tatlock (Principal Consultant) and Hanna Westling (Consultant) from Anthesis,* aiming to provide an outline of what is involved in setting a science-based target for Private Equity firms.

*The SBTi does not endorse, recommend or support any particular consultancies.

Investors and Limited Partners are increasingly asking what General Partners are doing to incorporate environmental, social and governance factors into investment processes, and more specifically to decrease exposure to climate risks and capitalize on transition-related climate opportunities. One of the most comprehensive responses a private equity (PE) firm can have is through setting a science-based target. To support, the Science Based Targets initiative (SBTi) launched the Private Equity Sector Science-Based Target Guidance (PE Guidance) in November 2021 to enable these firms to set targets for operations and investment portfolios aligned with the emission reductions needed to stay in line with well-below 2°C and 1.5°C climate scenarios.

This blog is the first of two that aims to provide an outline of what is involved in setting a science-based target for PE firms and the key practical steps to do so. Read the second blog here.

This series also serves as a prelude to the SBTi PE Guidance Walk-Through Webinar, which goes into more detail to further help PE investors understand the relevance of setting science-based targets, the key criteria to doing so, available resources for target development and how to prepare target submissions. The webinar was held across two time zones on 31 May and 1 June - view the recording here.

Key requirements and recommendations

Science-based targets to be approved by the SBTi cannot be set at an individual fund level. Instead, financial institutions (FIs) should only submit targets at the parent- or group-level. FIs are also not eligible to use the streamlined target validation route for small and medium-sized enterprises (SMEs).

One important prerequisite to setting a target for PE firms is to review available resources including the PE Guidance, blogs such as this one and webinars such as the PE Guidance launch webinar. Some key requirements and recommendations that can be found in these resources are outlined in the table below.

Another step before setting a science-based target, albeit optional, is to commit to setting a target. Upon signing the standard commitment letter, PE firms have two years to submit their target for assessment by the SBTi.

Topic | Requirements | Recommendations |

Scope 1 and scope 2 | Set scope 1 and 2 targets consistent with a 1.5°C pathway at a minimum (well-below 2°C aligned targets will be accepted until July 15, 2022) | - |

Scope 3 | Set a target for scope 3 category 15 emissions (loans and investments) | Set a target for scope 3 categories 1-14 emissions (including business travel) |

Scope 3 coverage | Set targets for all required asset classes, and disclose the percentage of assets under management (AUM) covered by portfolio targets | Set targets on all activities where methods are available |

Scope 3 target timeframe | Set near-term targets:

| Set long-term targets:

|

Actions | State the planned actions for reducing greenhouse gas (GHG) emissions | Establish a policy to phase out financial support to thermal coal by 2030 and annually disclose the annual investments, direct project financing and lending to fossil fuel projects and companies |

Progress | Annually disclose scope 1 and 2 GHG emissions, progress toward achieving all approved scope 1, 2 and 3 targets, and actions taken to meet targets | Annually disclose scope 3 GHG emissions |

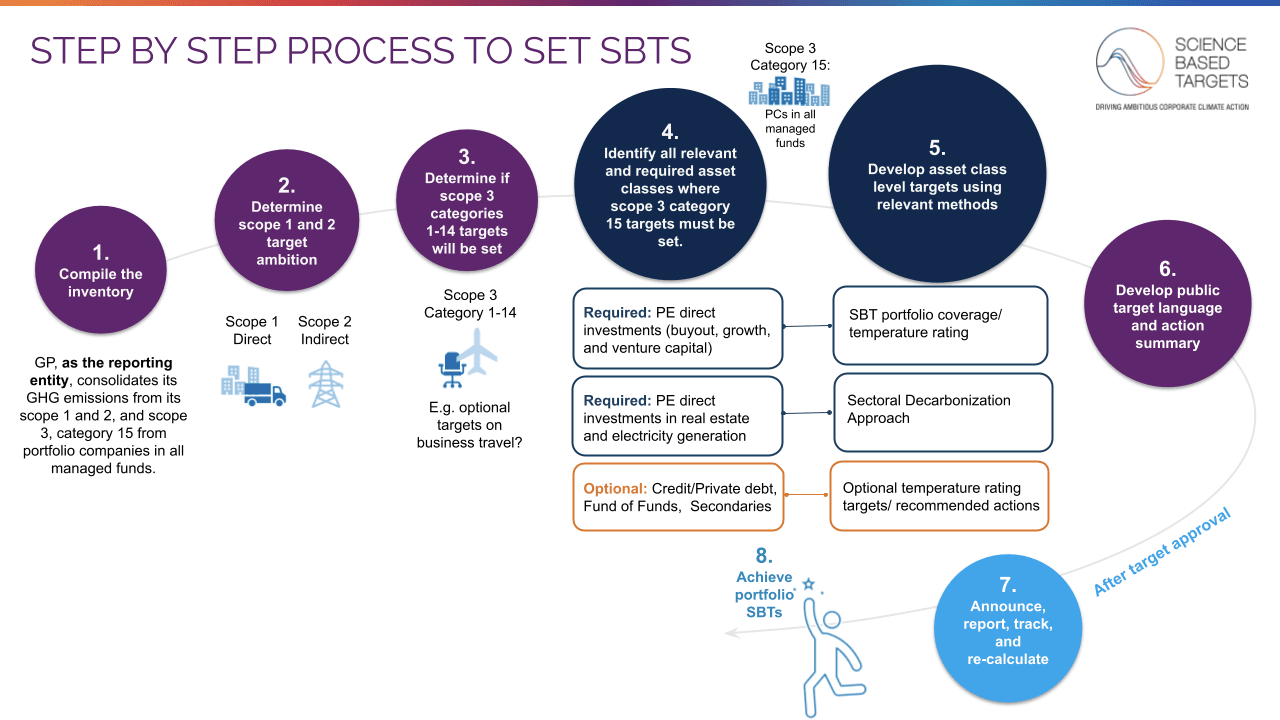

Steps 1 to 3: Compile GHG inventory and set scope 1, 2 and 3 categories 1-14 targets

Compiling the GHG inventory is required for the PE firms’ scope 1 and 2 emissions, and this needs to be submitted to the SBTi for the target validation process.

The minimum ambition of near-term scope 1 and 2 targets to align with a 1.5°C pathway is a 4.2% linear annual reduction in absolute emissions over the target period plus an adjustment for base years later than 2020. With this adjustment, targets with a base year later than 2020 must reduce emissions by at least the same amount overall as targets with a 2020 base year. For companies using a base year earlier than the most recent year, scope 1 and/or 2 targets must also have sufficient forward-looking ambition, as described in the SBTi Target Validation Protocol for Near-Term Targets.

PE firms should have a detailed GHG inventory for scope 3 categories 1-14. The SBTi also strongly recommends setting science-based targets for these scope 3 categories, in addition to scope 3 category 15. The minimum ambition of a near-term scope 3 target, if adopted, is a 2.5% linear annual reduction in absolute emissions over the target period plus an adjustment for base years later than 2020, as with scope 1 and 2 targets.

For additional information on steps 1 to 3, please see section 5 of the PE Guidance.

How are you practicing what you preach with your own GHG footprint? "We chose to set targets for our own scope 3 business travel emissions even though we were not required to by the SBTi. There are two main reasons for this: Firstly, business travel is the most material source of emissions related to our daily operations and hence the most important to address to make a real impact. Secondly, it is very important for our portfolio companies, clients, and shareholders to see that we aim to lead by example and that we are not taking the easy way out."

|

For scope 3 category 15 emissions, the SBTi appreciates that comprehensive GHG inventory data may not yet be fully available across all portfolio companies for all PE firms. One of the key objectives of setting portfolio targets is to also engage with companies to improve disclosure and transparency and therefore contribute to better data availability. The SBTi accepts the use of a financial selected metric, such as invested capital, as an alternative when using the Portfolio Coverage method until scope 1, 2, and 3 emissions of all portfolio companies are available. For additional information on the Portfolio Coverage method, please see section 6.3 of the PE Guidance.

Step 4: Identify all relevant scope 3 category 15 asset classes

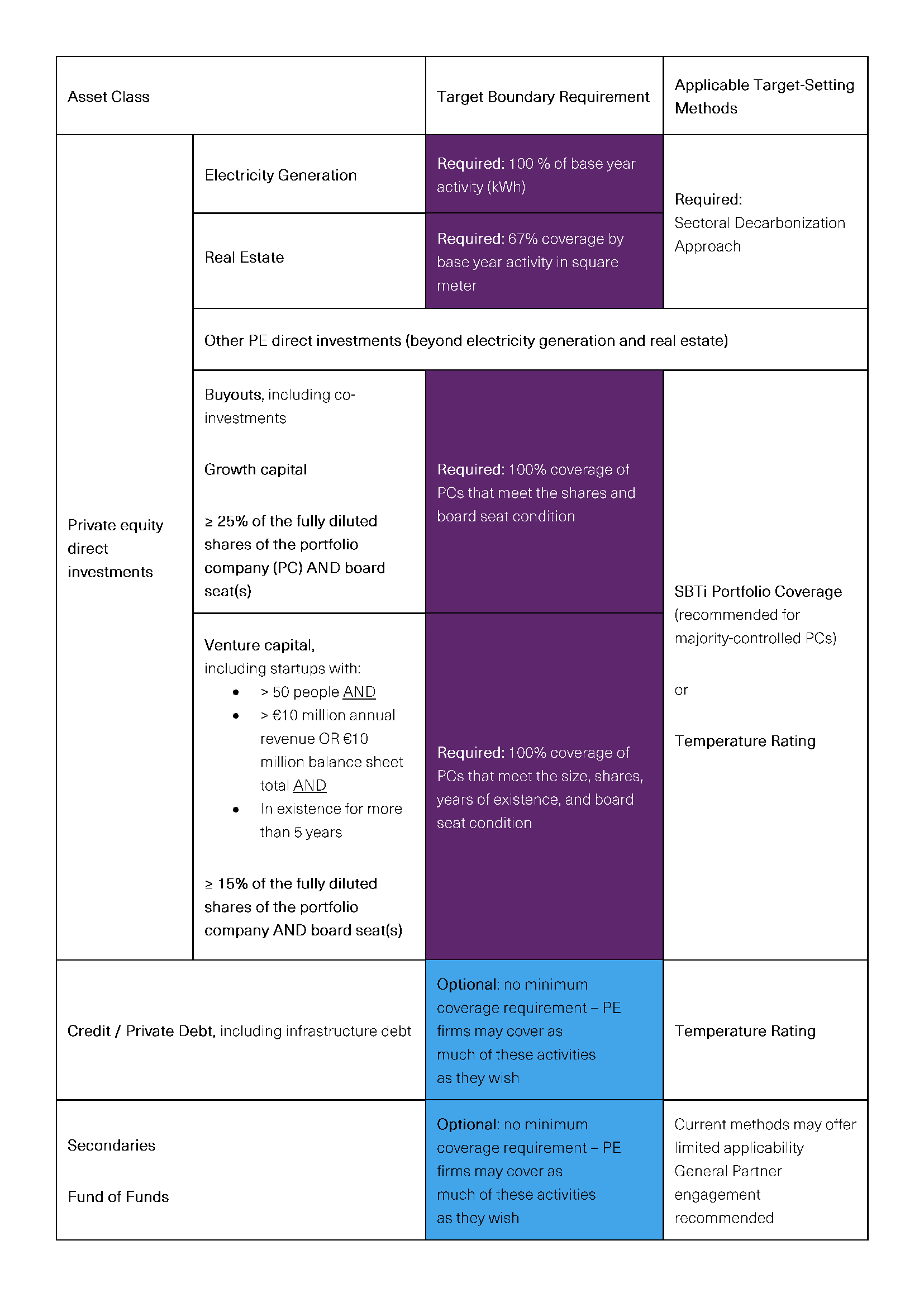

PE firms will need to self-classify their investments into asset classes. For those that have activities in asset classes that are not listed in the table below, the broader Financial Sector Science-Based Targets Guidance (FI Guidance) applies.

Both the PE and FI Guidance categorize asset classes as required, optional and out of scope, with specific minimum target coverage requirements (i.e. percentage that must be covered by a target) for the required asset classes, as well as the target-setting methods that are allowed to be used for each asset class.

The second blog of this series will cover steps 5 to 7 of setting a science-based target as a PE firm. A FAQ document will also be developed in the coming months to answer common questions raised by PE firms. In the meantime, the SBTi community forum for financial institutions provides the primary channel for questions and discussions on the PE Guidance and the wider sector framework.

Latest News

View News