FINANCIAL INSTITUTIONS

The finance sector is key to unlocking the system-wide change needed to reach a net-zero global economy. By using the SBTi’s current target-setting framework, financial institutions can set near-term science-based targets that align their investment and lending activities in line with climate science. Learn about our work to develop a Financial Institutions Net-Zero Standard.

Why should financial institutions take action?

More than 100 financial institutions worldwide have used SBTi criteria to set Paris-aligned near-term science-based emissions reduction targets across their operations and portfolios. Another 200+ banks, asset managers, private equity firms, asset owners, insurance companies and other financial institutions have committed to set their own science-based targets in the near future.

Financial institutions are increasingly recognizing the extent of climate risks and their influence on the global economy. Investment, lending and insurance activities must be urgently reviewed to avoid catastrophic climate change and fund a climate-secure, net-zero future.

Financial institutions can take action today by committing to set science-based targets and viewing our resources to develop targets.

About the SBTi’s Finance Sector Resources

The SBTi first launched the project to enable FIs to set near-term science-based emissions reduction targets in 2018. After a two-year development process, including expert advisory groups (EAGs), public consultations and pilot testing, the SBTi launched the Financial Sector Science-Based Targets Guidance Version 1 (FINT V1).

In May 2024, a suite of revisions to near-term target-setting resources for FIs, including the Financial Institutions’ Near-Term Criteria Version 2 (FINT V2), were released. The changes include criteria updates and clarifications to increase ambition as well as improve usability and clarity. An overview on the Financial Institutions’ Near-Term Criteria V2 was provided in a webinar which walked through the criteria, and explained key changes and how financial institutions (FIs) can use it to set ambitious emissions reduction targets.

Separately, the SBTi is developing a Financial Institutions Net-Zero (FINZ) Standard, which will require both near- and long-term targets that are consistent with achieving net-zero across FIs’ portfolios by 2050. SBTi is consulting widely on this and expects to publish the final Standard in 2025.

Financial support for SBTi’s work on FIs is provided by Bloomberg Philanthropies and ClimateArc, in addition to core SBTi funding from other sources.

Financial Institutions’ Near-Term (FINT) Criteria

Following a six-month discretionary period, FINT V1 (including V1.1 and 1.2) has now been retired. All financial institutions that want to set near-term targets should therefore use FINT V2.

In May 2024, the SBTi released FINT Criteria V2, along with a Main Changes Document, Criteria Assessment Indicators for FINT Criteria V2 and an explanatory document. These documents align with the Corporate Net-Zero Standard V1.2, provide clarifications, increase ambition levels, help address challenges raised by financial institutions and introduce criteria to address financial institutions' fossil fuel-related activities. A description of the various documents and key changes in FINT Criteria V2 can be found in this news bulletin.

These documents have gone through multiple rounds of research and drafting, including public consultation, pilot testing, and approvals by the Technical Council and SBTi Board. The development process of FINT Criteria V2 followed a streamlined version of the procedures outlined in the Standard Operating Procedure for Development of SBTi Standards because the project was already in an advanced stage of development when the procedure was formally adopted; however, the SBTi adhered to the procedures and processes where possible. More information on the development process as well as a list of revisions in FINT Criteria V2 can be found in the Main Changes Document.

FINT Criteria V2 is now required for all new target submissions. This change took effect from 30 November 2024, when FINT Criteria V1.1 was retired). Financial institutions that have SBTi-validated targets with previous versions of FINT Criteria are not required to update their targets for five years subsequent to their validation date, at which time the targets will need to be aligned with the latest available criteria. However, financial institutions are encouraged to update with the latest criteria as soon as possible.

In addition to the FINT Criteria V2 document, financial institutions can use the Financial Institution Sector section of the SBTi Criteria Assessment Indicators (CAI) to understand the relevant criteria by sector or target type. The CAI consolidates all criteria across SBTi resources, providing businesses with verifiable control points to use when developing science-based targets. It also provides clear and concise descriptions of the minimum documentation required to demonstrate alignment with each criteria point.

What's next?

Financial Institutions Net-Zero Standard

Keep up with the latest developments on our Net-Zero for Financial Institutions page. If you wish to submit feedback on the development of the FINZ Standard at any point in the process, you can do so via our project feedback form.

What is the SBTi’s definition of a financial institution?

The SBTi defines an FI as an entity that generates 5% or more of its revenue from investment, lending, or insurance activities. This includes but is not limited to banks, asset managers,private equity firms, asset owners,insurance companies and mortgage real estate investment trusts. Real economy companies that have more than 5% of revenue from financial activities are encouraged to use SBTi to set targets on those activities in addition to their corporate targets. Currently, public FIs such as central banks and multilateral development banks are not covered within the SBTi framework.

Learn more

Near-term criteria and explanatory documents

- Financial Institutions’ Near-Term Criteria V2

- Please note that the following translations have been provided. Targets must be submitted in English.

- FINT Criteria V2 (Arabic version)

- FINT Criteria V2 (Chinese version)

- FINT Criteria V2 (French version)

- FINT Criteria V2 (Portuguese version)

- FINT Criteria V2 (Japanese version)

- FINT Criteria V2 (Spanish version)

- Financial Sector Near-Term Science-Based Targets Explanatory Document V2

- Private Equity Sector Science-Based Target Guidance V1

Target services resources

- For FINT Criteria V2:

Target-setting tools

FIs must check the relevant SBTi sector webpages for the most up-to-date information before submitting targets to the SBTi.

- SBTi Finance tool for temperature scoring and portfolio coverage

- Corporate Near-Term Tool – This tool was developed for companies and can be applied to sector-level components of FIs’ portfolios. This version of the tool models targets with 1.5°C ambition, and includes the following sector-specific pathways: Power, Services - Buildings, Residential Buildings and Cement. To set targets on emissions related to other sectors with SBTi guidance available, refer to the applicable sector-specific tools on the sector webpages listed below.

- Aviation

- Buildings

- The Corporate Near-Term Tool can be used until February 28, 2025.

- The Buildings Target-Setting tool is available to be used now and will be required after February 28, 2025.

- Forest, Land and Agriculture (FLAG)

- Land Transport (for the use of financial institutions only)

- Maritime Transport

- Steel

- Science-based target setting tool - well-below 2°C for Financial Institutions – This tool is a modification of the above for use only by FIs. It is to be applied to sector-level components of FIs’ portfolios. This version of the tool is to be used for modeling targets with well-below 2°C ambition, and includes the following sector-specific pathways: Power, Iron & Steel, Cement, Aluminum and Pulp & Paper that can be used until November 30, 2024. From November 30, 2024 on, well-below 2°C targets can only be set for Aluminum and Pulp & Paper using this tool under the FINT Criteria V2.

FINZ Standard and Insurance resources

- Please see the Net-Zero for Financial Institutions webpage

Miscellaneous resources

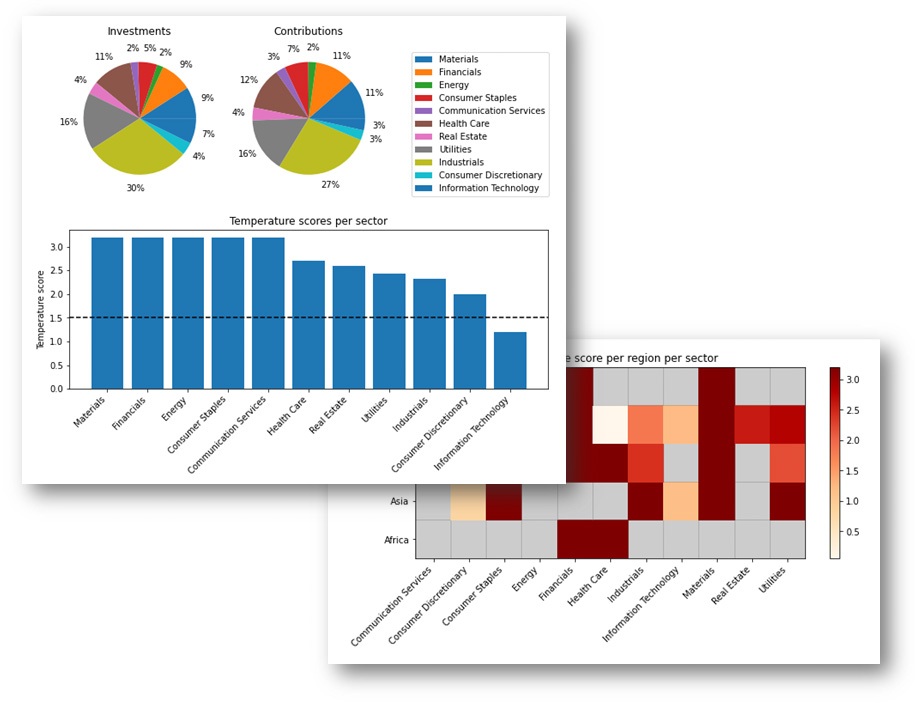

Temperature Scoring and Portfolio Coverage Tool for Financial Institutions

As part of its framework for FIs, the SBTi has developed a data-agnostic Python library that is primarily for integration into commercial and homegrown decision support and portfolio management systems, but can also be run as a standalone solution. It is based on the temperature scoring methodology developed by CDP and World Wide Fund for Nature. Temperature scores used for targets that are submitted to the SBTi for validation may be calculated using the SBTi open-source tool or other third-party temperature scores produced according to this methodology.

This tool helps financial institutions to assess the temperature alignment of current emissions reduction targets, commitments and investment and lending portfolios. The information can be used by financial institutions to develop GHG emissions reduction targets for official validation by the SBTi, develop engagement strategies and help with strategic investment selection and allocation decisions.

Tool & Resources

Technical Documentation (Online)

Data Requirements: Portfolio Data Template and Company Data Template

CDP-WWF Temperature Rating Methodology

Temperature Scoring Analysis Workflow Example

SBTi Finance Tool User workshop

SBTi Finance Tool Tech deep dive

SBTi Finance Tool Demonstration

The SBTi is allowing FIs that have publicly committed to setting a near-term SBT to extend their submission deadline until six months after the publication of the FINZ Standard V1.

- This extension is intended to allow the coordination of near-term and net-zero target development for SBTi assessment.

The extension is available to all publicly committed FIs with an active near-term commitment deadline up to six months after the FINZ Standard publication. The extension is optional.

FIs that wish to partake of this extension must inform SBTi prior to their current public expiration date. FIs may notify SBTi by sending an email to commitment@sbtiservices.com.

FIs with near-term science-based targets that have been validated by the SBTi will not be required to take further action until the expected revision of their targets five years after their validation.

All FI Net-Zero commitments are due 24 months after the release of the FINZ Standard.

The SBTi has developed a series of training modules to equip FIs with the tools and information needed to set near-term science-based targets against the current Criteria and Recommendations for FIs Version 1.1. Each module covers a different aspect of setting financial sector near-term science-based targets, ranging from making the business case for decarbonizing to completing target calculations.

View the full playlist on YouTube and below:

Module 2: Voluntary finance climate action ecosystem – video and slides

Module 4: Developing SBTs: Scope 1, scope 2, and scope 3 operational emissions – video and slides

Module 5: Developing SBTs: Scope 3 financed emissions – Overview – video and slides

Module 6: Developing SBTs: Scope 3 financed emissions – Calculation deep dive and case studies – video and slides

Module 7: Developing SBTs: Scope 3 financed emissions – Data considerations and trade-offs – video and slides

Module 8: Validating, disclosing, and recalculating – video and slides

Module 9: Governance, change management, and meeting targets – video and slides

The SBTi’s near-term target-setting framework for FIs was developed through an inclusive, multi-stakeholder process, including consultation with: an Expert Advisory Group (EAG) representing FIs, NGOs and academic institutions; FIs participating in method road testing; and general input from stakeholders during open and transparent public consultations. Here are highlights from the development process:

2024

- December: FINT V1 was officially retired, and FINT V2 became the required criteria for all new near-term target submissions from financial institutions.

- June: Hosted a global launch webinar for the Financial Institutions’ Near-Term Criteria V2. Watch the recording and view the slides.

- May: Published Financial Institutions’ Near-Term Criteria V2 as well as the associated Main Changes Document, Criteria Assessment Indicators for FINT Criteria V2 (from page 88), Target Submission Form for Financial Sector Near-Term Science-Based Targets V2 and Financial Sector Near-Term Science-Based Targets Explanatory Document V2.

- March-April: Received approval of the Financial Institutions’ Near-Term Criteria V2 by the Technical Council and SBTi Board.

- February: Concluded pilot testing of Draft Near-Term Criteria and Recommendations for Financial Institutions V2.

2023

December: Commenced pilot testing of the draft Near-Term Criteria and Recommendations for Financial Institutions V2

December: Published the SBTi Public Consultation Feedback Summary for the Draft Near-Term Financial Sector Science Based Targets Guidance V2 and Draft Fossil Fuel Finance Position Paper.

August: Concluded public consultation period.

July-August: Held multiple webinars to inform the public of the below public consultation drafts: Consultation Period Informational Webinar | Deep Dive Webinar Near-Term Guidance Update | Deep Dive Webinar Fossil Fuel Finance Policy Paper | Q&A Session 1 | Q&A Session 2

June: Released public consultation drafts of V2 of Near-Term Criteria and Recommendations for Financial Institutions and Near-Term Financial Sector Science Based Targets Guidance as well as the Fossil Fuel Finance Position Paper.

January: Released SBTi Financial Sector and TCFD Reporting Guidance

2022

August: Released V1.1 of the Financial Sector Science-Based Targets Guidance.

2021

November: Released Private Equity Sector Science-Based Target Guidance.

October: Validated the first science-based targets submitted to the SBTi by FIs.

2020

October: Published the SBTi Financial Institutions framework, including Criteria, Guidance, and Temperature Rating and Portfolio Coverage Tools.

August-October: Revised the first draft of the Financial Sector Science Based Targets Guidance based on feedback received in the survey and other engaged stakeholders; revised the Temperature Rating and Portfolio Coverage tool and tool documentation based on feedback received from beta testers.

August: Conducted a public consultation on the first draft of the Financial Sector Science Based Targets Guidance from August 6-27, 2020.

July-August: Launched beta testing of an open-source temperature scoring and portfolio coverage tool.

May: Participated in a webinar hosted by the Institute of International Finance to share a project overview and update. View recording.

May: Hosted a webinar to share a summary of stakeholder feedback on draft target validation criteria. Watch a recording and view slides.

April-May: Conducted public consultation to gather input from stakeholders on draft target validation criteria and tool development process that will serve as central components of the SBTi’s near-term target-setting framework for FIs.

April: Hosted a webinar to initiate public call for feedback on development of a new temperature scoring draft methodology for companies and investment portfolios. Watch a recording and view slides.

February: Hosted workshops in London and Tokyo to gather feedback from stakeholders on draft target validation criteria. View slides here.

2019

November: Co-hosted a webinar with Global Compact Network Australia and WWF to share progress on methodologies with financial institutions in Oceania and Asia Pacific. Watch a recording of the webinar and view slides.

October: Hosted a webinar to share a summary of feedback received from companies participating in the road testing process. Watch a recording of the webinar and view slides. Read a summary of method road-testing feedback (December 2019).

April-September: Gathered feedback from financial institutions and other stakeholders on draft asset class-based methods through road-testing process and an open stakeholder consultation.

April:Launched methods road-testing process. Watch a recording of the webinar and view slides.

February: Hosted EAG meeting to obtain feedback on the road-testing process.

2018

- December: Hosted EAG meeting to introduce the draft methods and solicit initial feedback.

September: Hosted first EAG meeting.

For queries relating to the development process, please contact financialinstitutions@sciencebasedtargets.org

Sign up for the SBTi's Finance newsletter to stay up to date with project milestones.

Browse more sectors

If your sector is not listed here, you can still set a science-based target using our methods and resources. Consult the step-by-step guide to get started.