Science Based Targets for Financial Institutions: 2022 in Review

16th Dec 2022

2022 has been a formative year for our work with private sector financial institutions (FIs), writes Nate Aden, Finance Lead at the Science Based Targets initiative (SBTi). He outlines the challenges faced, lessons learned and outlook for 2023.

This year has seen several important developments in the financial climate action space. In April, the IPCC’s Sixth Assessment Report (AR6) underscored the urgency for financial sector action with its finding that finance for mitigation must be three to six times higher by 2030 to limit warming to below 2°C. Regulators and policymakers raised the bar for corporate climate transparency with mandatory and proposed disclosure rules in Europe, the UK, and the United States, among other places. At COP27, the UN High-Level Expert Group report threw down the gauntlet on best practices for net-zero emissions commitments from FIs and other non-state actors. For their part, FIs accelerated their adoption and implementation of science-based targets, quadrupling the number of validated FI targets.

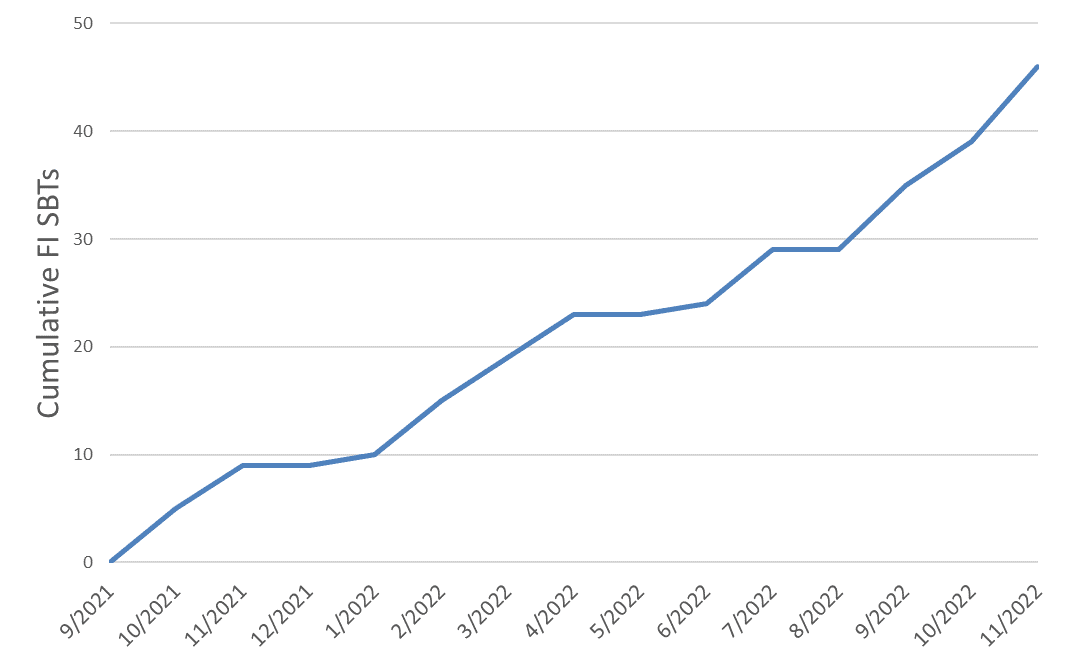

FI Science-Based Targets Quadrupled in 2022

Note: covers validated FI SBTs through November 2022.

Source: https://sciencebasedtargets.org/companies-taking-action

As illustrated by the steepening curve above, the pace of FI science-based target adoption is accelerating. In November, we validated seven FI targets - more than any previous month - and there are now more than 40 FIs that have submitted targets that are in the validation process.

Private equity (PE) firms were the most common type of FI to set science-based targets in 2021. In 2022, banks took the lead to become the most prevalent group with science-based targets (approximately one third of the total). The table below lists the FIs, FI types, headquarter locations, target-setting methods used and the dates of SBTi validation.

Name | Type of FI | Location | Method(s) Used* | Date of SBTi Validation |

EQT AB | Private Equity | Sweden | SDA, PCA | 21-Oct |

FSN Capital Partners | Private Equity | Norway | PCA | 21-Oct |

Investindustrial | Private Equity | United Kingdom (UK) | PCA | 21-Oct |

KB Financial Group | Bank | South Korea | SDA, TRA | 21-Oct |

La Banque Postale | Bank | France | SDA, TRA | 21-Oct |

Astorg | Private Equity | France | PCA | 21-Nov |

Bregal Investments | Private Equity | UK | PCA | 21-Nov |

Hg Capital | Private Equity | UK | PCA | 21-Nov |

Intermediate Capital Group | Private Equity | UK | PCA | 21-Nov |

Groupe Bruxelles Lambert | Financial Holding Company | Belgium | PCA | 22-Jan |

E.SUN Financial Holding Co., Ltd. | Bank | Taiwan, Province of China | SDA, PCA | 22-Feb |

Eurazeo | Private Equity | France | SDA, PCA | 22-Feb |

KIRKBI A/S | Financial Holding Company | Denmark | PCA | 22-Feb |

Schroders | Asset Manager | UK | TRA | 22-Feb |

Terra Alpha Investments LLC | Asset Manager | United States of America (USA) | PCA | 22-Feb |

Amalgamated Bank | Bank | USA | SDA | 22-Mar |

Bupa | Insurer | UK | TRA | 22-Mar |

Carnegie Fonder AB | Asset Manager | Sweden | PCA | 22-Mar |

JAB Holding Company | Financial Holding Company | Luxembourg | PCA | 22-Mar |

Axcel Management | Private Equity | Denmark | PCA | 22-Apr |

Montagu | Private Equity | UK | PCA | 22-Apr |

Sycomore Asset Management | Asset Manager | France | PCA | 22-Apr |

VP Capital | Financial Holding Company | Belgium | SDA, PCA | 22-Apr |

JB Financial Group Co., Ltd. | Bank | South Korea | SDA, TRA | 22-Jun |

COFRA Holding AG | Financial Holding Company | Switzerland | PCA | 22-Jul |

Hannon Armstrong | Project Finance | USA | SDA | 22-Jul |

IK Investment Partners Limited | Private Equity | UK | PCA | 22-Jul |

Taishin Financial Holdings | Bank | Taiwan, Province of China | SDA, PCA | 22-Jul |

Yuanta Financial Holding Co Ltd | Bank | Taiwan, Province of China | SDA, PCA | 22-Jul |

Cathay Financial Holding Co., Ltd | Bank | Taiwan, Province of China | SDA, TRA | 22-Sep |

DGB Financial Group | Bank | South Korea | SDA, TRA | 22-Sep |

EV Private Equity | Private Equity | Norway | PCA | 22-Sep |

Fubon Financial Holdings | Bank | Taiwan, Province of China | SDA, PCA | 22-Sep |

MeaningsCapitalPartners | Private Equity | France | SDA, PCA | 22-Sep |

Raiffeisen Bank International AG | Bank | Austria | SDA, PCA, TRA | 22-Sep |

Argos Wityu Partners S.A. | Private Equity | Luxembourg | PCA | 22-Oct |

Hana Financial Group | Bank | South Korea | SDA, TRA | 22-Oct |

Norron Asset Management | Asset Manager | Sweden | PCA | 22-Oct |

Actiam N.V. | Asset Manager | Netherlands | PCA | 22-Nov |

DeVolksbank N.V. | Bank | Netherlands | SDA, PCA | 22-Nov |

Direct Line Insurance Group plc | Insurer | UK | SDA, TRA | 22-Nov |

Pictet Group | Asset Manager | Switzerland | SDA, PCA | 22-Nov |

Rathbones Group Plc | Asset Manager | UK | PCA | 22-Nov |

Shinhan FInancial Group | Bank | South Korea | SDA, TRA | 22-Nov |

SK Securities Co., Ltd | Investment Company | South Korea | SDA, TRA | 22-Nov |

Bank of Ireland Group | Bank | Ireland | SDA, PCA | 22-Dec |

NatWest Group | Bank | UK | SDA, TRA | 22-Dec |

* Sectoral Decarbonization Approach (SDA), SBTi Portfolio Coverage Approach (PCA), Temperature Rating Approach (TRA) as defined in the SBTi Finance Guidance.

The growing group of FIs with validated science-based targets illustrate three trends in private sector climate finance.

Action is becoming more geographically dispersed as the need to address climate change moves further up the corporate and FI agendas. In 2021, all but one of the FI science-based targets were based in Europe or the UK. In 2022, one third of FI science-based targets have been from other countries including the US.

Different FI types are using different target-setting methods. Banks uniformly use the Sectoral Decarbonization Approach (SDA) to set sector-level targets, whereas asset managers and PE firms use portfolio coverage or temperature rating methods to set engagement targets. Additional research is needed to understand the links between FI type and target-setting method, but two factors may be banks’ access to borrowers’ detailed sector-relevant data and the influential voting rights accrued by investors.

Larger FIs are setting science-based targets. This is illustrated by the most recently validated FI, NatWest Group, which reported total assets of £782 billion at the end of 2021. In addition to being large, NatWest Group is the first UK bank to have a validated target. This science-based target demonstrates emerging best practice with its high sector granularity and inclusion of scope 3 category 1-14 emissions and residential mortgages, which are technically optional under present SBTi Finance criteria.

Challenges

While the growing group of FIs with validated science-based targets provides grounds for optimism, we have identified five common challenges to scaling private sector climate finance.

FIs’ climate knowledge and emissions data are in their early stages. This makes sense as FIs are traditionally oriented toward maximizing financial returns. The good news is that helpful resources such as the Partnership for Carbon Accounting Financials (PCAF) financed and facilitated emissions standards are becoming more available.

Asset managers often cite traditional notions of fiduciary duty to explain their reluctance to develop and implement climate targets in third party or passive funds. Vanguard's departure from the Net-Zero Asset Managers Initiative is a recent example.

The coverage, ambition and methods for FI climate target setting vary across the broad range of existing initiatives. This challenge includes confusion around fundamental concepts, such as the link between near-term science-based targets as discussed above and net-zero commitments.

A fourth challenge that has become more acute for FIs in the US is the politicization of FI climate and ESG policies, with states such as Florida targeting individual FIs.

Politicization in the US demonstrates an aspect of the fifth, broader challenge of effectively linking public and private sector finance for the purpose of climate mitigation. In 2022, the Bridgetown Initiative and newly formed Just Energy Transition Partnerships (JETPs) are examples of rising approaches to build geographically dispersed public-private finance links.

These challenges are not comprehensive or conclusive, but rather illustrate impediments to the rapid scaling needed for climate stabilization.

Lessons learned

It’s still early days for FI science-based targets, but the past year has yielded three lessons learned.

It is clear that FIs are central for climate stabilization from mitigation, adaptation, and loss & damage perspectives. Within SBTi this is evidenced by the effective engagement of FIs with client and investee companies in the real economy who then set their own SBTs.

- The FI landscape is wide and complicated. SBTi Finance initially produced unified FI Guidance, but quickly discovered that it’s difficult to create “one size fits all” rules (criteria) for such diverse asset classes. Our initial solution, the SBTi Private Equity Guidance, has proven effective at catalyzing action among that group of firms as mentioned above. On a capacity front, there are two subsets of this lesson:

Banks are deploying sector targets – additional sector coverage and tools could help scaling.

Asset managers are deploying engagement targets – additional SBTi validation capacity will be needed to support scaling across investee, borrower, and client companies.

Finally, we have observed that FIs would benefit from more support for setting, tracking and achieving their emissions reduction targets. In particular, this refers to technical capacity on emissions data and target-setting methods, standardization and policies to support climate disclosure and mitigation action.

Outlook for 2023

To support the transformation of private sector climate-aligned finance, the SBTi is focusing on three areas in 2023:

Scaling FI science-based targets: We will build on the training modules produced in 2022 to introduce clarified and updated near-term criteria as well as an improved FI target submission form.

Thought leadership: We will build on our FI net-zero (FINZ) Foundations work to advance the development of the SBTi FINZ Standard. This will include a review of the near-term criteria and methods toward creating a single integrated standard for near- and long-term targets. We will also develop new target-setting methods for insurance underwriting and other additional asset classes.

Strategic partnerships: SBTi Finance is deeply aware that it is one part of a broad ecosystem that ties together finance and climate outcomes. To advance harmonization and strategic partnerships, the SBTi is developing principles for target-setting method selection and co-developing positions on key issue areas such as fossil fuel investment policies.

Are you interested in learning more about SBTi Finance and FIs with science-based targets? Join our mailing list and/or register for one of our January 24 webinars.