Deep dive: The role of carbon credits in SBTi Corporate Net-Zero Standard V2

Jul 8th 2025

This blog is part of an ongoing series in which we unpack key topics that we are exploring as we continue to evolve the draft Corporate Net-Zero Standard Version 2 through the next steps of the revision process.

The SBTi released an initial draft of the Corporate Net-Zero Standard Version 2 for public consultation over a 90 day period from March to June 2025, where more than 855 stakeholders contributed their expertise and input on proposed changes.

As we continue to evolve the draft Standard through the next steps of the revision process, this blog is part of an ongoing series in which we unpack key topics that we are exploring such as scope 1, 2 and 3 emissions and environmental attribute certificates (EACs). Here, we will dive into the topic of carbon credits, and their potential use cases within the draft Standard.

With global temperatures now breaching the 1.5°C threshold more frequently, the urgency to decarbonize corporate operations and value chains has never been higher. At the same time, there is a pressing need to unlock finance for mitigation activities beyond company boundaries, including nature-based solutions and emerging carbon removal technologies.

The updated Corporate Net-Zero Standard V2 proposes ways in which high-quality carbon credits can support corporate net-zero target setting in a way that complements, rather than substitutes, the decarbonization of operations and value chains.

What are carbon credits?

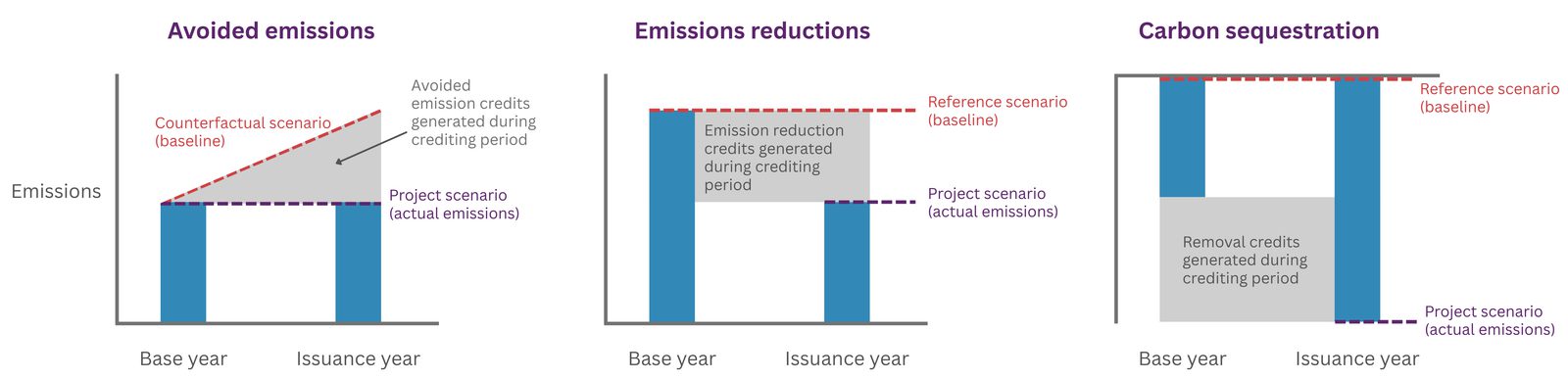

Carbon credits represent the mitigation outcomes of projects that result in lower greenhouse gas (GHG) emissions compared to a reference scenario. Based on these mitigation outcomes, carbon credits can be classified into three main categories:

- Emissions avoidance credits: Issued for activities that prevent potential future emissions compared to a counterfactual scenario. For example, a renewable electricity project may generate carbon credits if, in the absence of revenue from carbon credit sales, a more carbon-intensive alternative would have been built and operated instead. In this case, the volume of carbon credits issued does not reflect emissions that were directly reduced or eliminated from thermal power plants in operation, but rather emissions that were prevented from occurring.

- Emissions reduction credits: Issued from activities that reduce or eliminate emission sources. Examples of these activities include minimizing the leakage of greenhouse gas emissions, capturing and destroying methane from waste or wastewater treatment facilities, capturing and destroying non-CO₂ industrial gases, reducing fossil fuel consumption through a broad range of measures (e.g. energy efficiency, electrification, etc.), or switching from higher-carbon to lower-carbon energy sources.

- Carbon removal credits: Issued for activities that capture carbon from the atmosphere and transfer it to durable carbon pools. These credits represent net negative emissions resulting from human intervention, including the enhancement of natural carbon sinks and technological removals, such as direct air capture with geological storage.

What are the potential use cases for carbon credits that are proposed within the draft?

As with the current version (V1.2) of the Standard, the consultation draft of V2 does not propose the use of carbon credits as a substitute for decarbonizing operations, supply chain activities, or products. Instead, it outlines three use cases where high-quality carbon credits may be used to supplement value-chain decarbonization efforts. These three cases are intended to be supported by an enhanced claims and assurance framework that recognizes companies not only for taking action to decarbonize their value chains, but also for supporting mitigation beyond their value chains and contributing to the scale-up of carbon removal activities.

These three cases are described in more detail in this blog:

- Use case 1: Use of carbon credits from removal activities to counterbalance the impact of residual emissions.

- Use case 2: Contribution to mitigation activities outside of a company’s value chain as a way to take responsibility for the emissions that they continue to release every year on the way to net-zero.

- Use case 3: Removal of carbon to take accountability for underperformance against targets. This use does not imply that targets have been achieved, nor does it negate the need to abate emissions that could not be reduced during the target period.

Acknowledging the different use cases and intended claims, different quality criteria may apply to the carbon credits used in each case.

Use case 1: Counterbalancing the impact of residual emissions

What are residual emissions?

Residual emissions refer to the volume of greenhouse gases that remain after a company has implemented all feasible abatement measures across its operations and value chain by its net-zero target year (i.e. by 2050 at the latest). These emissions are defined based on Paris-aligned mitigation scenarios and represent sources that cannot be fully eliminated, even with the deployment of all mitigation options considered in these scenarios.

What are the proposed approaches for how companies can proactively address residual emissions?

The draft Standard proposes three approaches to address residual scope 1 emissions in the run-up to net-zero:

- Mandatory removal targets: Companies would be required to set long-term removal targets to counterbalance the impact of (projected) residual emissions, including interim milestones towards this goal.

- Optional recognition for setting removal targets: Under this model, companies would not be required to set removal targets, but would be recognized for doing so.

- Option to use removals to address residual emissions (without explicit targets): In this case, companies retain the option to use removals to address residual emissions but are not required to determine this upfront. This option is intended to provide flexibility, allowing companies to decide on the most appropriate approach to mitigate these emissions. Whether by developing solutions to abate them or by neutralizing them if abatement remains unfeasible.

How could carbon credits potentially be used?

In all three models, carbon credits could potentially be used to demonstrate that carbon is being removed to address residual emissions.

In this use case, given that the intended function is to neutralize the impact of emissions that continue to be released into the atmosphere, specific quality attributes may be required to substantiate such claims. These include durability, avoidance of double claiming, sustainability guardrails for removal activities, and additionality.

The draft Corporate Net-Zero Standard V2 proposes two options for ensuring durability:

- Like-for-like approach: Match residual emissions with removals that offer a storage duration comparable to the atmospheric lifetime of the greenhouse gas being neutralized.

- Gradual transition: Enable a phased shift from temporary to more durable removals over the 2030 to 2050 period, aligned with the pace of deployment of removal solutions reflected in climate scenarios. This flexibility allows for the prioritization of finance towards the protection and enhancement of natural carbon stocks, recognizing their critical role in delivering near-term mitigation and co-benefits, while still encouraging investment in the development and scale-up of durable removal technologies over the longer term.

The SBTi is exploring these options and applicable quality attributes through feedback from the public consultation and the Expert Working Group on removals, to inform the final version of the Standard.

Use case 2: Taking responsibility for ongoing emissions

What are ongoing emissions?

Companies continue to release emissions while they work to implement transformations to achieve net-zero emissions. These are referred to as ‘ongoing emissions’. Ongoing emissions accumulate in the atmosphere and are a primary driver of anthropogenic climate change.

What are the proposed approaches for incentivizing companies to take responsibility for their ongoing emissions?

The draft Corporate Net-Zero Standard V2 builds on the SBTi’s Above and Beyond report by proposing formal recognition for companies that take responsibility for ongoing emissions, supporting climate mitigation beyond their value chain. Through these actions, companies can demonstrate enhanced climate leadership, not only by reducing their climate impact but also by contributing to the acceleration of societal transformation towards a low-carbon future.

When considering how to design the optional recognition framework, there are five factors that the SBTi is deliberating with the Expert Working Group on beyond value chain mitigation (BVCM):

- Scope of emissions to be addressed: Defining the boundary of emissions for which companies should take responsibility (e.g. across scopes 1 to 3, scope 1 and 2 only, or scope 1 and 2 plus a portion of scope 3).

- Scale of contribution: Determining what constitutes a sufficient contribution to be recognized as taking responsibility for ongoing emissions, whether based on financial spend, mitigation volume, or a combination of both.

- Type of contribution: Identifying acceptable mechanisms for taking responsibility for ongoing emissions, such as the purchase of high-quality carbon credits, direct investments in mitigation projects, or conservation of carbon in natural ecosystems.

- Timeframe for contribution: Establishing whether contributions should be made annually, at the end of each five-year target cycle, or following another defined cadence.

- Progress against targets: Considering whether recognition should be conditional on the company having achieved its science-based targets, or whether demonstrating “meaningful progress” would be sufficient.

How could carbon credits potentially be used?

Companies can make these contributions through a range of instruments, one of which includes the purchase and retirement of high-quality carbon credits. This may include activities that avoid or reduce greenhouse gas emissions as well as activities that remove and store greenhouse gasses from the atmosphere.

For this use case, in principle, all types of carbon credits originating from outside the value chain can be included, and, in this case, quality attributes may differ, depending on the intended claims. The different attributes for the use of carbon credits are being explored through the relevant working groups.

Use case 3: Taking accountability for underperformance against targets

What is target underperformance?

Target underperformance occurs when a company does not reach the level of abatement intended in its emissions reduction targets by the target date, creating a gap between planned and actual emissions trajectories. This leads to an excess accumulation of greenhouse gas emissions in the atmosphere relative to the science-based trajectory, which is designed to align the company’s emissions with a Paris-aligned carbon budget.

What are the proposed approaches for how companies can address underperformance?

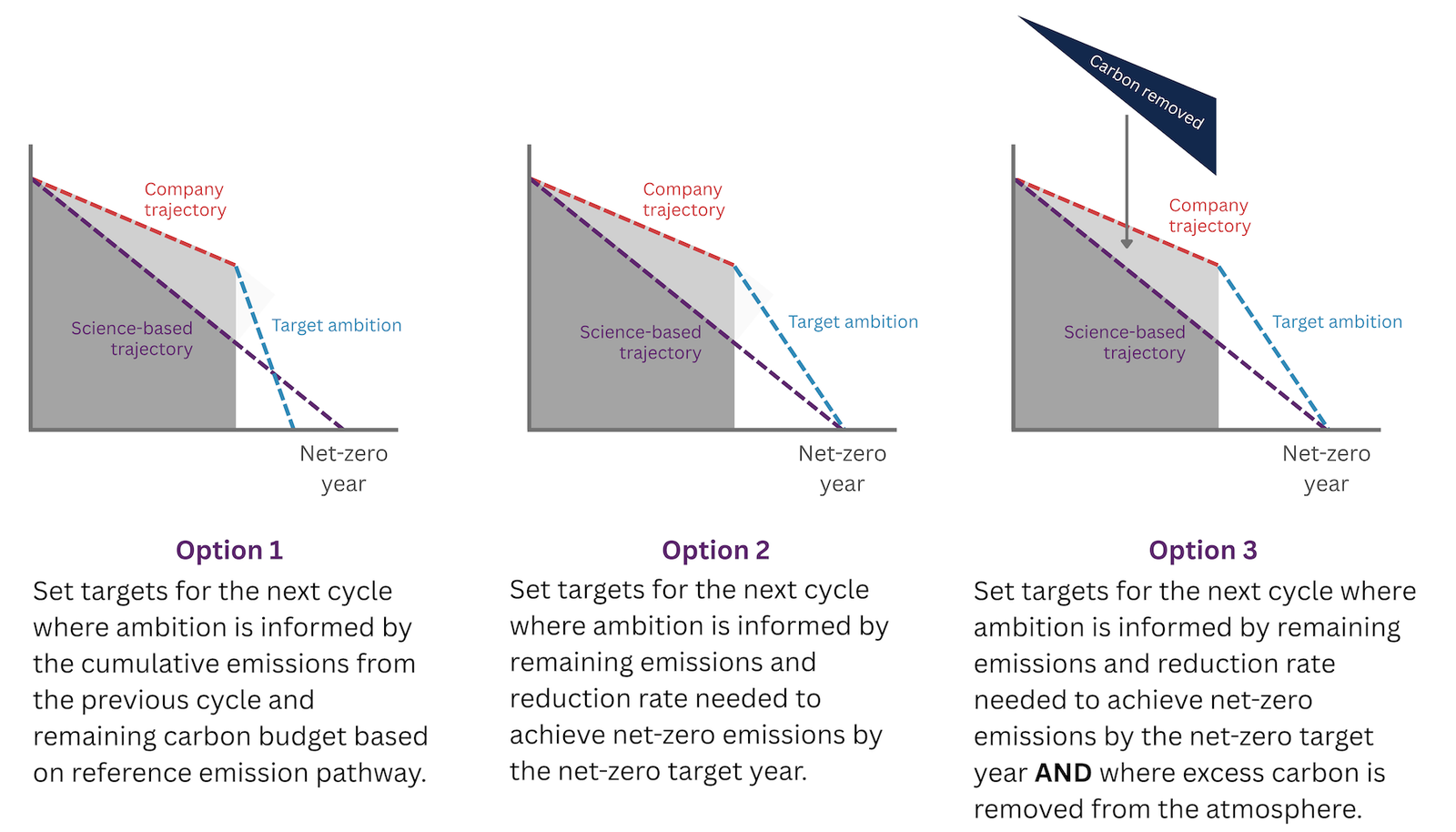

If a company falls short of its target, the draft Corporate Net-Zero Standard V2 outlines three possible options to address this:

- Option 1 - Budget-Conserving Contraction Approach: In this case, the target ambition for the next cycle is adjusted, considering any potential underperformance or overachievement for the previous cycle, ensuring that cumulative emissions for both cycles are consistent with the Paris-aligned carbon budget.

- Option 2 - Linear Contraction Approach: In this case, the target ambition for the upcoming cycle is informed primarily by the remaining gap between the level of emissions already achieved (i.e. emissions in the more recent year) and the level of reductions still needed to achieve net-zero emissions by the net-zero target year.

- Option 3 - Linear Contraction Approach, plus removals: As above, but also requires durable removals to account for target underperformance in the previous target cycle.

Of these three options, option 2 is expected to result in higher cumulative emissions.

How could carbon credits potentially be used?

For companies that are not able to achieve the intended emission reductions stated in their targets, high-quality carbon credits from removal activities could potentially serve as a measure to take accountability for underperformance and to address any potential overaccumulation of carbon in the atmosphere. As illustrated in the diagram above, the use of carbon removals to address potential underperformance, does not negate the need for companies to reduce these emissions at a rate consistent with achieving net-zero emissions by the net-zero target year. The use of removals represents an additional measure that companies take to address the atmospheric impact of excess emissions from the previous cycle.

Given the intended use, the quality attributes of carbon credits in this context may need to be similar to those required for addressing residual emissions, in order to ensure the intended atmospheric effect.

Refining the role of carbon credits in the Corporate Net-Zero Standard

The SBTi is currently continuing to evolve the proposals within the draft Standard, including those related to carbon credits. Next steps in the revision process:

- Review and analysis of feedback from the first public consultation

- Ongoing discussions with experts through dedicated working groups

- Refinement of proposals based on stakeholder input and additional research

- Publication of a second consultation draft in late 2025, alongside pilot testing with companies

- Preparation of a final draft for review and approval by the SBTi Technical Council

We encourage all stakeholders to continue to engage in this process. Your expertise can help ensure the final Corporate Net-Zero Standard V2 provides clear, actionable guidance that accelerates corporate climate action and supports a high-integrity system essential for the net-zero transition.

To stay informed on key developments and future engagement opportunities, sign up to our mailing list and follow us on social media.

Latest News

View News