Case study - Schroders

Schroders is a global asset management firm headquartered in London. It has operated for over 200 years, committed to set science-based targets in 2021, and was one of the first financial institutions to have its targets validated by the SBTi.

Employing over 5,500 people at 37 locations around the world, Schroders plc manages more than US$990 billion on behalf of institutional and retail investors, financial institutions and high net worth clients from around the world. It is the largest asset management firm with approved science-based targets to date.

The SBTi spoke with Madeleine Cobb, Global Head of Corporate Sustainability at Schroders to learn more the asset management firm and its targets.

What is Schroders’ science-based target?

Schroders’ target accounts for operational and investment-associated emissions. For our scope 3 emissions, i.e. the investments we manage:

- Align our in-scope assets under management (AUM) from 2.92°C in 2019 to a 2.19°C by by 2030, across financed scope 1 and 2 emissions

- Align our in-scope AUM from 3.13°C in 2019 to 2.29°C by 2030 across financed scope 1, 2 and 3 emissions, which is in line with a 1.5°C pathway by 2040

Based on the SBTi criteria, our in-scope assets currently include listed equities (common stock and preferred stock), corporate bonds, Exchange Traded Funds (ETFs) and Real Estate Investment Trusts (REITs) asset classes.

For our own operations:

- Reduce absolute scope 1 and 2 GHG emissions by 46% by 2030 from a 2019 base year

- Increase annual sourcing of renewable electricity from 50% in 2019 to 100% by 2025

Why did you set a science-based target?

Our impact analysis of climate change models that long-run returns may be materially different when the impact of climate change is taken into account. We believe that every economy, industry and company will need to plot a net-zero path to remain competitive. As such, we aspire to become one of the world’s leading investment companies with sustainability at our core. We are proud to have become the largest asset manager by AUM to have its targets validated by the SBTi. It is a recognition of our commitment to climate leadership, and we hope it will encourage our peers to take similar action.

What was Schroders’ experience using the SBTi’s Financial Institutions framework to set its target?

The SBTi’s Financial Institutions framework has become a familiar document to many of us within Schroders. It provides great detail and precision to determine both the assets in scope for an organization like ours, as well as methodology details that are critical to ensuring comparability across users. Given the disparate conclusions different temperature methodologies reach for the same companies, that precision is key. In general, we have adopted the CDP-WWF alignment approach; although we have developed complementary models, we consider it more effective for decision making in some investment strategies. The CDP-WWF specification provides a valuable reference against which to determine targets and report on our progress.

We believe that the SBTi has become the leading industry standard for climate mitigation. The consistency and comparability of the SBTi approach are critical for our industry and others to drive and demonstrate progress.

How did Schroders determine the ambition level for its targets?

At the time of committing to set targets with the SBTi (February 2021), we opted to go for the highest ambition available to a financial institution by setting science-based targets across all relevant scopes in line with the criteria and recommendations of the SBTi. We also committed to setting a long-term target to reach net-zero emissions across our value chain no later than 2050 once the SBTi releases net-zero guidance for financial institutions [due out in 2023]. This option ensures the strongest ambition in the long term and enables companies a degree of flexibility in how quickly they align in the short to medium term with trajectories that lead to net-zero emissions by 2050. This flexibility was also important with regards to available methodologies for different asset classes for financed emissions in line with a 1.5°C pathway.

In 2022, we are committed to expanding that scope to include other asset classes including sovereign bonds and real estate.

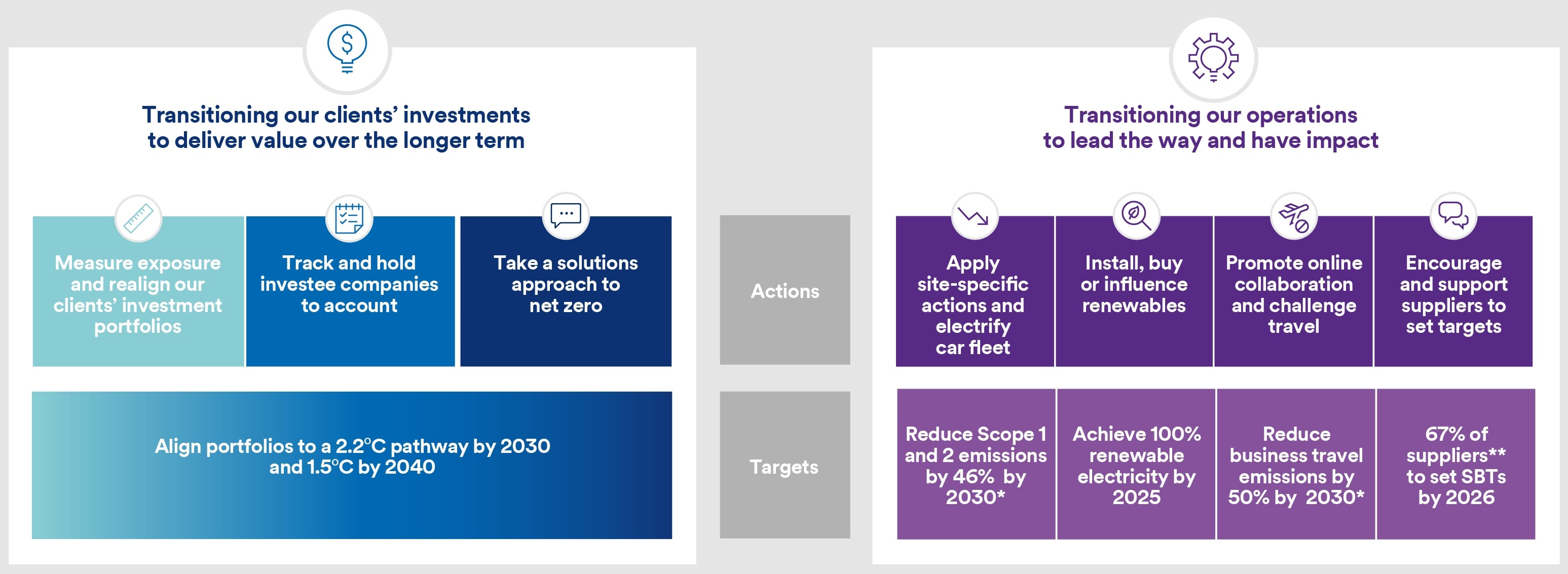

What action is Schroders taking to achieve its target?

We have built on years of climate research, risk analysis, proprietary tool development and action to understand and manage the risks and opportunities posed by climate change. We have made several commitments to accelerate progress on managing climate risk and achieving net-zero by 2050 or sooner, spanning both our operations and the investments we manage. Over the next decade our decarbonization strategy will focus on the following key elements:

Operations

- Transition to a hybrid or fully electric company car fleet by 2025 (with the aim to be fully electric by 2030).

- Increase annual sourcing of renewable electricity to 100% by 2025.

- Reduce absolute business travel GHG emissions by 50% by 2030 from a 2019 base year.

- Work with our suppliers so that 67% of suppliers by emissions covering purchased goods and services, capital goods and upstream transportation and distribution will have science-based targets by 2026.

Investment

- Continue to measure and assess exposure to climate risk through our Climate Risk Toolkit, including scenario analysis, and to realign our clients’ investment portfolios when appropriate.

- Track and hold investee companies to account, calling on companies to demonstrate near-term delivery of decarbonization goals, focusing on the most exposed companies and assets ; we will apply our Climate Engagement and Escalation Framework.

- Take a solutions-based approach to net-zero and develop investment products allowing clients to connect their capital to real-world emissions reductions.

What challenges to decarbonization are you facing as an investment firm and how are you addressing them?

We are under no illusions and understand that transitioning our business to 1.5°C, even over almost 20 years, will be a huge undertaking and will require significant and immediate changes across our firm. Driving the portfolios we manage to align with 1.5°C will require a significant increase in the share of global companies committed to ambitious emissions reductions. A global asset manager like ourselves cannot build diversified portfolios from those companies already committed to that transition. Engagement with portfolio companies will be key, encouraging them to establish ambitious decarbonization goals and strategies. The scale of that engagement demands it be approached as a whole-firm effort, and we have established engagement targets for all analysts and fund managers, on which they will be assessed at the end of each year. Financial markets and emission reduction pathways will not move in lockstep, so ensuring we navigate the investment risks and opportunities of long- term decarbonization trends will require new models and analytical tools which we continue to invest in building and developing, as well as investment discipline .

A Call to Action for the Finance Sector

Financial institutions are key in decarbonizing the global economy, which is why the SBTi has developed and continues to develop resources and tools to support these companies in their target setting process for their investment and lending portfolios.

Visit the financial institutions page to learn more about how to join our group of climate leaders, commit to the SBTi, and set a science-based target.

Latest News

View News