Case Study - JAB

JAB is a investment partnership between JAB Holding Company as an evergreen investor and creator of global leading Investment Platforms and JCP as a strategic co-investor. Read on to discover more about JAB's steps to achieve its science-based target.

JAB is focused on the consumer goods and services sector with offices in London, Amsterdam, Washington D.C., São Paulo, Luxembourg, and Mannheim. With over $50 billion in managed capital, JAB's portfolio spans six platforms: coffee & beverage, fast-casual restaurants, petcare, pet health services, beauty & luxury, and indulgence.

(JAB Holding Company’s science-based target applies to all JCP investments.)

To learn more about JAB and its science-based targets (SBT), the SBTi spoke with Jacek Szarzynski, JAB Holding's ESG Partner.

Why did you set a science-based target?

Given the inextricable link between achieving strong, long-term returns and the health of the planet and society, we recognize that the investment community has a crucial role to play in advancing progress on ESG issues, especially climate change. We believe that all investors can be active participants in the climate transition as they serve as stewards of financial, human, social, and natural capital, and JAB’s science-based targets are an expression of this belief. Our unique approach and long-term investment horizon give us the ability to look beyond short-term market cycles and commit to supporting our portfolio investments in business decisions that build lasting value for our stakeholders.

JAB has a fundamental belief that taking a sustainable value creation approach to business pays off for consumers, businesses, capital partners, suppliers, and the firm itself. JAB was among the first cohort of financial institutions to set emissions reduction targets with the Science Based Targets initiative (SBTi).

What is JAB’s science-based target?

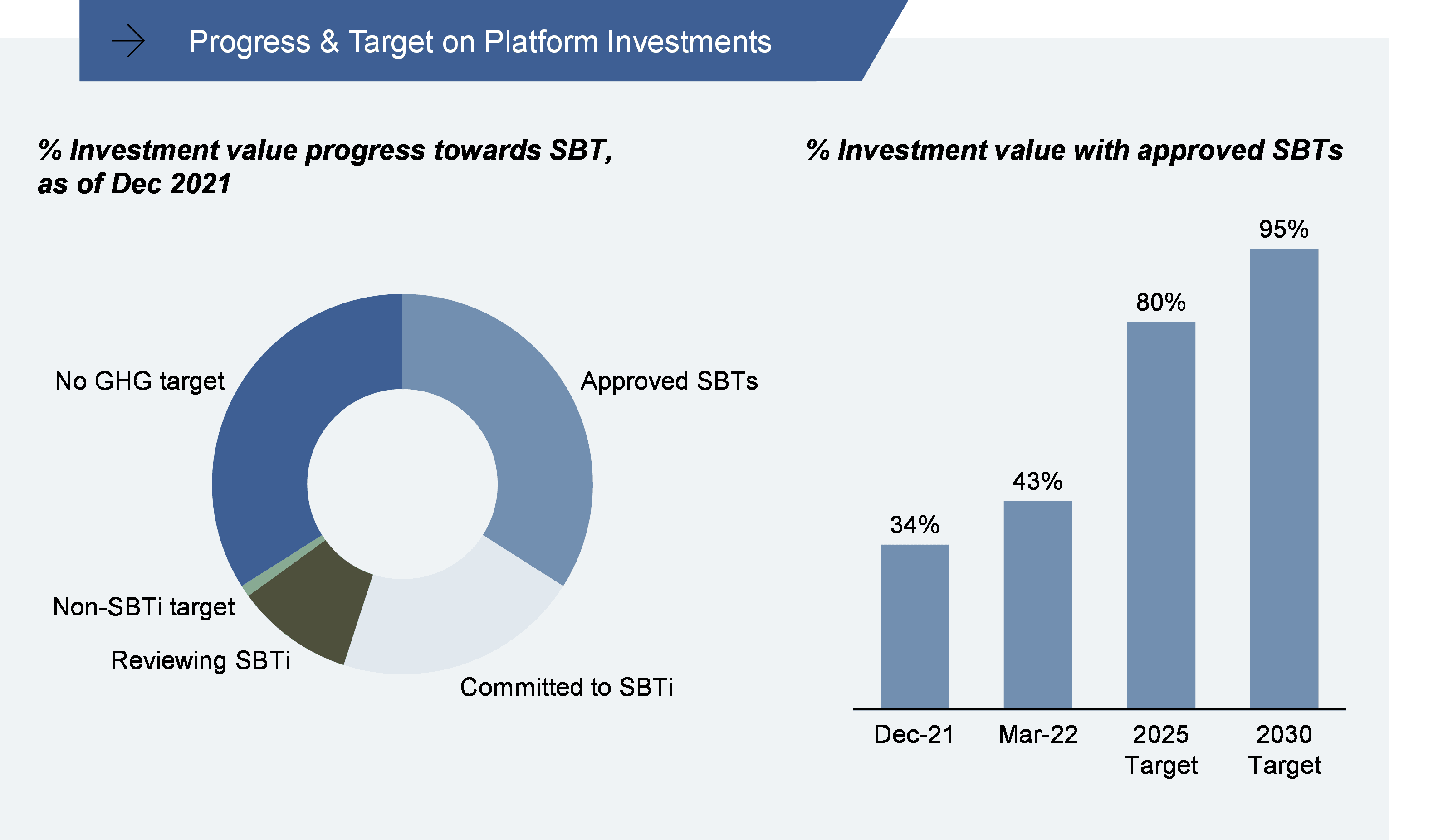

We were one of the first investment firms globally to engage in setting science-based targets in 2021 as part of the original pilot of the SBTi’s Financial Framework. Our 1.5°C-aligned target was submitted in October 2021, approved in January 2022, and officially announced in March 2022. We have committed to reducing absolute Scope 1 and 2 GHG emissions by 46% in 2030 from a 2020 base year. Our Scope 3 portfolio target covers 99% of total investment activities as of 2021. We have also committed that 80% of our portfolio investments (by invested capital at fair value) will have set SBTi-validated targets by 2025, increasing to 95% by 2030. We are proud to say that this is one of the most ambitious science-based targets in the investment community to date.

What was JAB's experience using the SBTi's Financial Institutions framework and Private Equity sector guidance to set its target?

Our experience was very positive. The way the guidance is set up clearly shows that it has been developed with investors in mind. One example is the portfolio coverage approach as a target-setting method for emissions from investments (Scope 3, category 15). This allowed us to set a target on the share of portfolio investments that have adopted their own science-based targets, which was a logical approach for us because, as an investment firm, more than 99% of our carbon footprint is linked to our investment portfolio. Furthermore, we appreciated the option to use a financial metric as a proxy for GHG emissions to set our target coverage on Scope 3. This allowed us to make progress on setting our target and move quickly towards execution.

How did JAB determine the ambition level for its targets?

The first step we took in preparing our climate strategy was conducting in-depth research into the science, frameworks, and actions others were taking across all stakeholder groups. The Paris Agreement was the obvious guidepost, and the SBTi provided us with the gold-standard framework for addressing emissions reductions for ourselves and our platform investments.

When it came to deciding on the ambition for our short-term 2025 Scope 3 portfolio coverage target, we first assessed the progress within our portfolio, summarized in the illustration below. We realized that achieving 40-60% coverage in 2025 would be relatively easy to achieve. We instead landed on a more aggressive 80% coverage target, ensuring that a broad cross-section of the companies we invest in benefit from the long-term performance and reduced risk associated with robust climate action as soon as possible. Our SBT is urgent and ambitious because we believe this will help drive progress within our circle of influence, as well as potentially inspire others in the industry to take on more aggressive goals.

What action is JAB taking to achieve its target?

While JAB’s investments operate independently, we actively engage with each to embed JAB’s ESG priorities into their strategy and operations, as well as pursue their own tailored ESG agendas. We enable our portfolio companies to share best practices through our ESG Collaboration Forum, which takes place every quarter. I chair the meetings, and the participants include sustainability experts and C-suite leaders from all of JAB’s portfolio companies. The Collaboration Forum provides our portfolio companies with the opportunity to jointly discuss progress and challenges experienced in executing their ESG agendas. It also enables leadership teams from both private and public companies to work together. This dynamic is unique to JAB thanks to our long-term ownership model and continued engagement with our companies once they become public. Furthermore, in 2022 we are setting up a Climate Collaboration Working Group to explore enablers of decarbonization that can be adopted across our portfolio.

Externally, we publish annual and half-year reports that include updates on both our financial and ESG performance, including progress towards our science-based target.

What challenges to decarbonization are you facing as an investment firm, and how are you addressing them?

There are several challenges related to ESG implementation and decarbonization. At the institutional level, we are still working to help investors understand the link between long-term performance and a robust ESG strategy. We know that the financial success of businesses we invest in is intrinsically linked with the health of the world. That is why increasing transparency and disclosure are some of the most important tools we have. They allow us to course-correct and ensure we are diligent and hard-nosed in our pursuit of shareholder returns while also maintaining our focus on a strong ESG agenda. This transparency also helps us stay true to our mission of long-term value creation instead of chasing short-term solutions to drive temporary success.

In addition, there are countless different standards, frameworks, and metrics that make driving a systematic ESG roadmap a difficult and complex undertaking. As a result, investors sometimes link sustainability efforts with weaker financial performance due to perceived distraction from core business operations. However, we know the opposite is true, which is part of the reason we engaged with the SBTi – they provided a cogent and thoughtful framework for ambitious climate action that brings much-needed standardization and discipline.

At the company level, we face the challenge of both the range and scope of our portfolio, which touches millions of consumers and suppliers across a vast range of organizations. This results in our portfolio companies requiring varying levels of support and engagement, all while maintaining the strictest focus on performance. In addition, the business models in our portfolio vary significantly across platforms, and the leaders of all the companies balance multiple and diverse objectives. Some are already well advanced on their decarbonization journey, while others are just at the beginning. For this reason, we will continue learning and will aim to be agile and adapt our approach to deliver the best possible outcomes in this particularly important field.

A Call to Action for the Finance Sector

Financial institutions are key in decarbonizing the global economy, which is why the SBTi has developed and continues to develop resources and tools to support FIs in their target setting process for their investment and lending portfolios.

Visit the financial institutions page to learn more about how to join our group of climate leaders, commit to the SBTi, and set a science-based target.

Latest News

View News