New resources for scaling private sector climate action

26th Apr 2022

The SBTi's Nate Aden explains why the SBTi supports new climate disclosure proposals from the US Securities and Exchange Commission, European Financial Reporting Advisory Group and International Sustainability Standards Board.

Amid increasingly dire warnings from climate scientists, regulators across the world are providing resources for companies to disclose their greenhouse gas emissions more consistently and comprehensively. Proposals from the U.S Securities and Exchange Commission (SEC), European Financial Reporting Advisory Group (EFRAG), and International Sustainability Standards Board (ISSB) would make company climate reporting mandatory. To understand emissions liabilities and move toward climate stabilization, companies and other stakeholders should support these proposals to ensure they are enacted.

In April, the IPCC issued its second warning of 2022 via the Sixth Assessment Report, Working Group III report on climate mitigation. Among other things, the report made it clear that greenhouse gas emissions must peak by 2025 to avoid catastrophic climate change. If this is to be achieved, the private sector must pursue rapid, coordinated and sustained action to reduce emissions.

Welcoming mandatory climate reporting

The Science Based Targets initiative (SBTi) welcomes the SEC, EFRAG, and ISSB proposals as an essential next step in standardizing diverse company and financial institution approaches to climate reporting. If adopted, they would ensure consistent climate data availability, thereby providing a foundation for climate-aligned investment, lending and accountability.

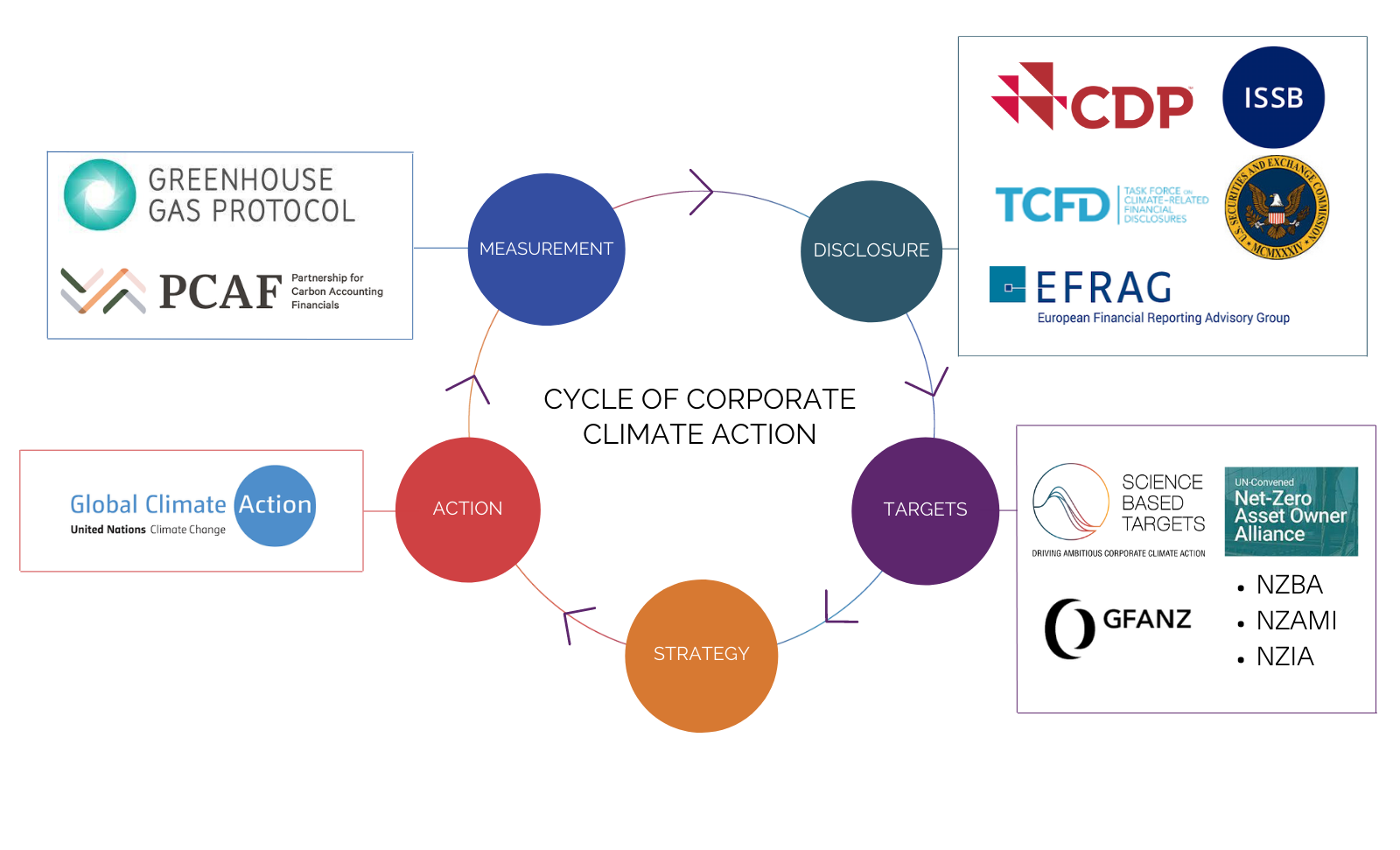

Transforming companies to align with climate stabilization outcomes is an extensive process that can be summarized in six iterative steps:

- Measurement

- Disclosure

- Target-setting

- Strategy

- Action

- Monitoring (i.e. re-measurement).

The first step for companies and financial institutions is to begin estimating and measuring their greenhouse emissions inventories. The Greenhouse Gas Protocol (GHG Protocol) provides an accounting foundation for quantifying company and financial institution direct (scope 1 and 2) and indirect (scope 3) greenhouse gas emissions. Scope 3 emissions can occur across 15 upstream and downstream categories across value chains, starting with purchased goods and services and ending with financed emissions associated with investment and lending activities. The Partnership for Carbon Accounting Financials (PCAF) has built on the GHG Protocol Scope 3 Standard to elaborate additional financed emissions methods and resources. These are two leading examples of the growing group of resources for companies and financial institutions to measure their emissions.

CDP has been collecting company and financial institution environmental information since 2002. In 2017, the Financial Stability Board’s Task Force for Climate-Related Financial Disclosures (TCFD) laid the foundations for the current climate disclosure conversation with its Recommendations report on climate-related physical and transition risk. The SEC, EFRAG, and ISSB proposals build on the voluntary TCFD recommendations with mandatory regulatory frameworks. While some jurisdictions have introduced reporting requirements, the broader mandatory disclosures signified by these proposals are an essential next step for scaling up company climate action. This is because they would ensure standardization and complete coverage of laggards as well as leaders.

Among financial institutions, many have publicly allied with the Glasgow Financial Alliance for Net Zero (GFANZ) and its constituent net-zero alliances: the Net-Zero Asset Owners Alliance (NZAOA), the Net-Zero Banking Alliance (NZBA) the Net-Zero Asset Managers Alliance (NZAMI) and the Net-Zero Insurance Alliance (NZIA), among others. Whereas GFANZ and its affiliated alliances have mobilized member institutions with trillions of dollars of assets under management, the SBTi uses mandatory criteria to assess financial institution and company-specific targets. The mobilization and strategy support provided by GFANZ is an essential complement to the SBTi’s independent target assessment.

Beyond targets and strategy, the UN Global Climate Action Portal is an established platform that describes and aggregates climate mitigation actions, bringing us back to measurement of effectiveness and impact.

The changing nature of climate action

Four attributes of these disclosure proposals illustrate the changing nature of climate action and a potential pathway to broader climate stabilization:

- Scope 3: The proposals’ inclusion of scope 3 emissions is a positive new development that builds on the practices of the SBTi, where more than 1,300 companies and financial institutions have quantified their scope 3 emissions and, where material, set scope 3 value chain emission reduction targets. Understanding value chain relationships is integral to the systemic transformation required for climate stabilization.

- Accessible data: These proposals would improve companies’ emissions data and make them more accessible to a broader group of stakeholders, including investors and regulators. Closing the gap between financial and non-financial reporting will facilitate the creation of a climate-aligned economy.

- Climate accountability: Companies risking our collective future through continued investment in stranded assets will become increasingly exposed to commensurate litigation risks. Accountability discussions are also informing the changing understanding of fiduciary duty with regard to time horizons and climate impacts.

- Increased mitigation: Companies and financial institutions consistently point to data limitations as the primary challenge for integrating climate into their business models. From a finance perspective, additional data and harmonization support the SBTi’s strategy of engagement as the first best option for achieving emissions reductions in the real economy.

After measurement and disclosure, target-setting, strategy and action must follow for companies to reduce their emissions in line with climate stabilization. Within this private sector cycle of climate action, the SBTi’s standards and growing group of assessed targets provide a platform for transparently driving increased mitigation action. Awareness and actions are growing, but it is still early days for the private sector’s broader climate alignment.

Next steps for companies

Unvalidated climate self-declarations - with 90% of the global economy committed to net-zero - have fuelled concern about greenwashing. In response, the UN Secretary General launched a dedicated High-Level Expert Group to scrutinize net-zero commitments at the end of March. While high-level pronouncements are helping to raise awareness, the continued global growth of emissions underscores the need for science-based mitigation action. The disclosure proposals discussed here are an essential next step, but are hardly sufficient. Four opportunities for supporting additional climate action you can take include:

- Submit comments on the proposals. The SEC proposal was published in the Federal Register on April 11 and is open for public comment until May 20, and the EFRAG and ISSB proposals also have open comment periods. Beyond supporting mandatory disclosures inherent in these proposals, three opportunities for increased ambition are broader scope 3 data reporting requirements, mandatory target-setting, and harmonization (e.g. between the U.S., EU and China and across sectors).

- Participate in the SBTi Finance Net-Zero Standard development process. All stakeholders are invited to participate by joining our mailing list (where we’ll advertise public workshops and new resources), posting to the SBTi Finance online forum and applying to join the SBTi Finance Net-Zero Expert Advisory Group.

- Disclose. Leading companies and financial institutions should not wait for mandatory disclosure: they can get ahead of the curve by measuring their emissions, disclosing their physical and transition risks in their TCFD reporting.

- Set science-based targets: Developing the most ambitious science-based target possible, and implementing actions to reduce emissions now, must be done urgently by as many companies as possible.