Linking Carbon-Reduction Targets to Economic Value Added: Making Sense of Science

Sept 25th 2014

Towards ‘climate-stabilizing’ corporate carbon-reduction targets

Although setting corporate carbon-reduction targets is nowadays commonplace, many targets are grounded in ‘guestimates’ of what seems reasonably achievable or at least looks reasonable for external purposes and are often short-term in nature. Some mask an actual increase of absolute emissions as a result of growth and/or are set as intensity targets linked to sales, revenue, production or number of employees, but bearing no direct linkage to the actual reductions that would be required according to scientific bodies such as the IPCC.

In addition, carbon-neutral or zero-carbon goals often still rely heavily on offsetting, a valuable albeit last-resort measure in reducing corporate carbon (equivalent) emissions.

One may wonder why explicitly building carbon-emission thresholds into a company’s performance metrics has taken so long? A key reason may be the need to allocate such thresholds proportionally to individual emitters. This not only poses challenges as to how to go about this but also raises a suite of questions around fairness and equity as well as who’s holding the moral high ground.

Back in 2008, British telecom company BT pioneered its Climate Stabilization Intensity model, introducing carbon-emission targets set relative to the company’s economic value-added and scientific thresholds. A small number of companies have since followed in its footsteps: Autodesk subsequently developed C-FACT, a “Corporate Finance Approach to Climate-stabilizing Targets” to operationalize the BT approach using accepted accounting techniques.

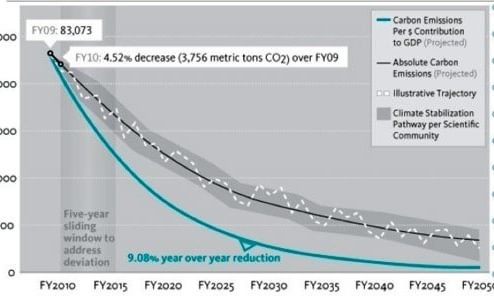

The C-FACT model argues that corporate commitments should be proportional to their contribution to GDP and not the corporation’s existing size and footprint. By calculating the company’s contribution to annual GDP and its carbon intensity ratio in CO2-e per dollar of GDP contribution, next linking this to the IPCC’s recommended reduction target for climate stabilization by 2050, an annual carbon-intensity reduction target can be derived to guide the required level of absolute emission reductions. The free C-FACT tool has recently been expanded to make it suitable for use by cities, acknowledging the role of cities as the world’s engines of economic growth. In fact, an upcoming conversion to a web-based tool will make the use of C-FACT Cities as easy as anything.

Where C-FACT calls for a fixed percentage reduction of GHG-emission intensity year over year, EMC, a key provider of IT storage hardware solutions, reckons that we’re still in the midst of a considerable learning curve for, in particular, distributed energy-generation technologies — leading to shorter paybacks and higher efficiency as technologies mature over time. Instead of a fixed reduction percentage, EMC has decided to accelerate carbon reductions year on year, anticipating to achieve greater ‘value for money’ for its future carbon-reduction efforts compared to current.

Nonetheless, precious few corporates apply such goal-setting against real-world, science-based thresholds; whether relating to carbon or other environmental and social‘planetary boundaries.’ While several organizations such as CDP , WRI and WWF are starting to make the case for increased ambition on corporate target-setting through the recently announced ‘Science Based Targets’ initiative, let’s check out a different approach which is steadily gaining ground: the use of internal carbon fees.

Putting an internal price on carbon

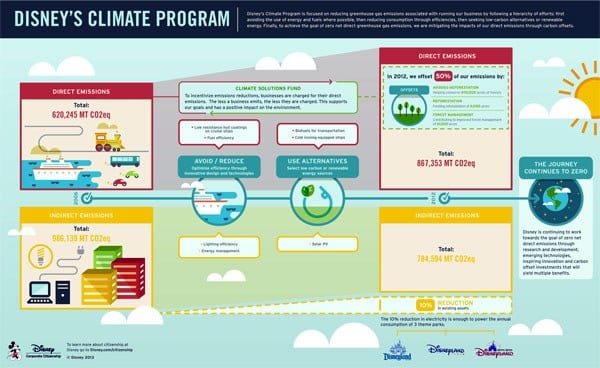

A complimentary approach to carbon targets based on economic value-added (but not necessarily carbon thresholds) is the emerging practice of putting an internal price on carbon. This usually means either allocating a fee across different divisions or business units pending their impact, or using a price on carbon for the planning of new projects. Corporate resource extraction giants such as Shell and Exxon use so-called shadow carbon prices as a regulatory impact tool to help ensure that multi-billion dollar investments remain profitable for decades under stricter environmental rules. An increasing number of companies though, of which perhaps most notably Microsoft and Disney, charge internal business sections for the carbon directly or indirectly emitted as a result of their activities.

By assigning financial accountability for corporate carbon emissions, the argument goes, a rapid increase in internal awareness can be realized, driving culture change towards leaner and cleaner operation as well as capital expenditures. In reality, quite a few companies currently set the boundaries at scope 1 and 2 carbon emissions, leaving scope 3 activities such as air travel financially unaccounted for. Furthermore, it’s important to note that the vast majority of internal carbon fees are currently not grounded in scientific consensus on the level of carbon reductions required to stabilize our global climate.

A recent study by CDP found that the range of disclosed internal carbon fees for 2013 amongst corporates ranged from US$6-60 for 1 unit of tCO2-e and from US$2-161 in the various markets created through governmental carbon-pricing initiatives. The lower end of the corporate carbon fee range is mainly dominated by those who use it for chargeback purposes, while the higher end represents the shadow prices adopted for future planning purposes, such as the US$60 per ton adopted by Exxon.

When we compare this to analysis by Michael Molitor (SciencePo) into the level of decarbonizing of the global economy needed up to 2050 — whilst scaling it up to meet the demands of a rapidly increased world population — a minimum price of US$40 per ton of CO2-e emitted is suggested, slowly rising to US$100 per ton in order to generate significant long-term reductions in carbon emissions.

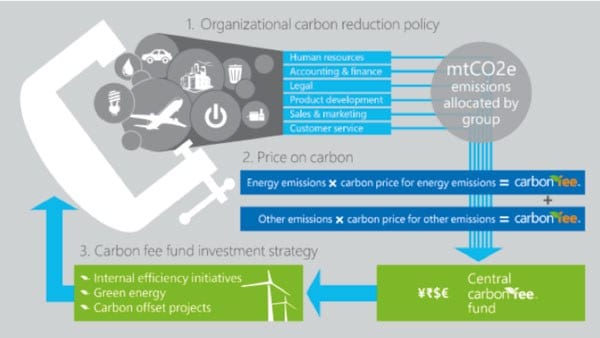

Although few firms will provide detailed insight into their internal carbon-pricing mechanisms, Microsoft has intentionally published its current practices to encourage broader uptake in the market. Its internal carbon fee is determined on the basis of current market pricing for renewable energy credits (RECs), carbon offsets and an additional amount to provide funding to support other investments including internal efficiency.

The three primary components of Microsoft’s carbon fee model — Source: The Microsoft carbon fee: theory & practice; Microsoft

This is an approach taken by many organizations, developing a set of two or more internal prices on carbon. First of all, to reflect the price of generating or purchasing green power to avoid emissions associated with electricity usage and secondly, to reflect the cost of investing in carbon offset projects to offset remaining emissions. The total cost on carbon may also include investments in internal efficiency initiatives and other elements which make up a company’s investment strategy.

How high to set a price on carbon will however often need be balanced by a need to initially focus on internal education and building awareness, as well as to avoid abruptly shocking the system. A company may therefore choose to start low while increasing the internal carbon fee and subsequent investments over time, as the benefits become better understood within the organization.

Nevertheless, it is worth pointing out that corporate carbon pricing without effective carbon-reduction targets may be nothing more than cost-effective. The actual effectiveness of carbon pricing is after all a matter of its price level and how (broadly) it is applied; not just the fact there is one!